- India’s subsidies for sugar production are in breach of World Trade Organisation (WTO) rules.

- The country will therefore refrain from offering subsidies in 2022.

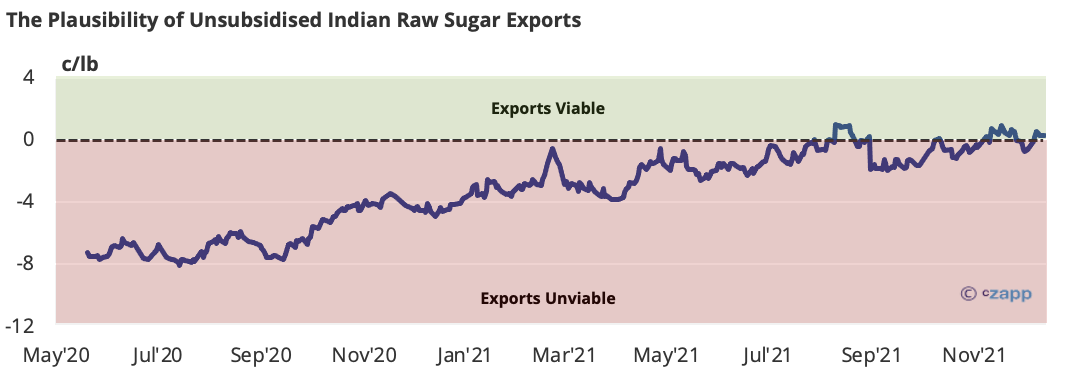

- Sugar prices are close to a level where India can export without a subsidy, though.

WTO Ruling and Right to Appeal

- The WTO has ruled against India’s sugar subsidies; this probably isn’t very surprising for most people.

- The subsidies were in breach of WTO rules that govern the levels at which nations can subsidize domestic agricultural production.

- We believe India will now appeal the decision, so it still has the right to control and protect the domestic cane and sugar economy.

- They have 60 days to launch an appeal, which will then be stuck the WTO’s appellate body.

- However, this body is unable to act at the moment as it doesn’t have enough sitting members.

- The USA has been blocking new appellate appointments to protest what it sees as WTO over-reach.

- This means that if India appeals, it can continue as it likes.

India’s Sugar Subsidies: A Recap

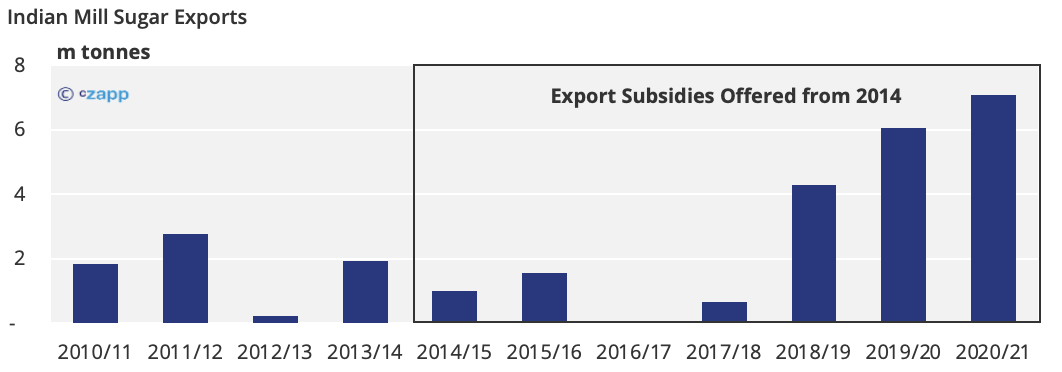

- The Indian government has subsidised sugar exports to the world market since 2014.

- It’s also provided the sugar sector with a host of other support measures, including minimum domestic prices, stock support and subsidised loans.

- The cane price paid to farmers is also set by the Government, irrespective of domestic or world market sugar returns.

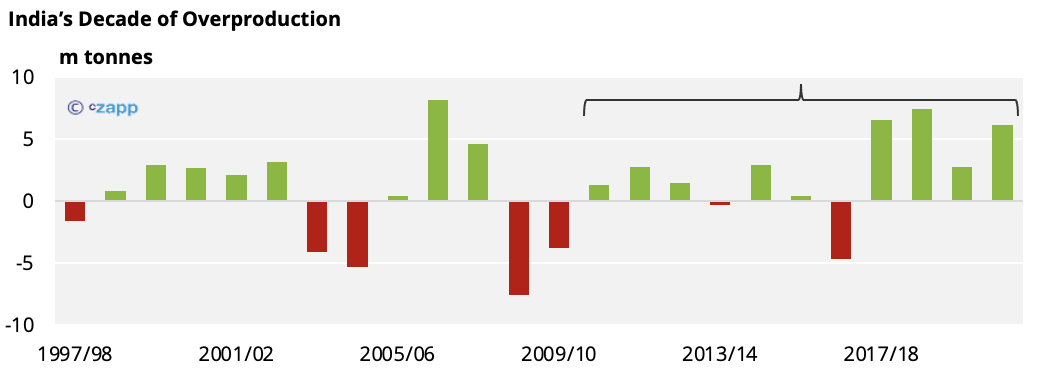

- In 2019, Brazil, Australia and Guatemala complained that India’s subsidies to farmers violate world trade rules, leading to sugar overproduction and lower world market prices.

- At the same time, India issued a robust defence of its right to support cane farmers livelihoods.

- More recently, the government admitted that export subsidies must finish by the end of 2023 under its interpretation of WTO rules.

- For the past six months, that hasn’t been a problem as world market sugar prices have been high enough for exports to work with no subsidy.

- For 2021/22, 3.5m tonnes of unsubsidised exports have already been contracted.

- The Indian government, though, can’t guarantee that world market sugar prices will be high enough for Indian exports to remain viable; India’s cost of production is as high as 19 c/lb in some states.

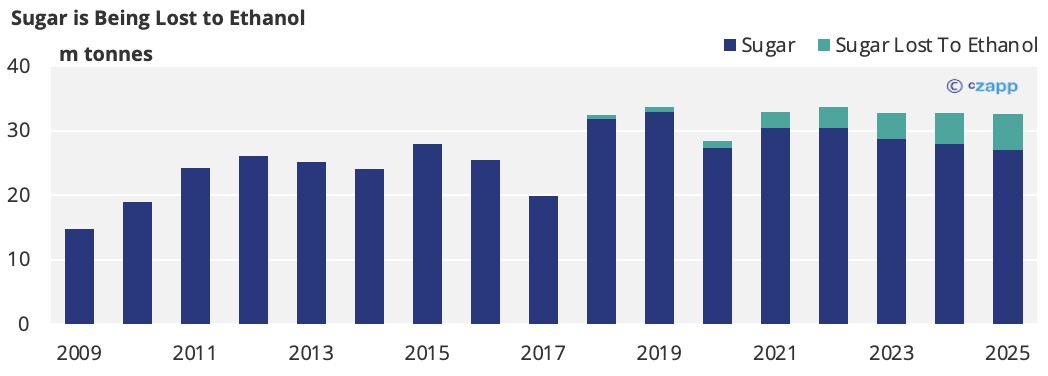

- The Government has therefore increased its fuel ethanol blend rate to 20% to utilise its excess sucrose.

- In 2021/22, more than 3m tonnes of sugar could be diverted to ethanol and this will grow in the future.

- To ensure this, the Government has offered incentives to encourage sugar mills to invest in distillation capacity, most notably INR 165b low interest loans.

- Domestic ethanol prices have also been set at profitable levels for sugar mills.

- Provided the ethanol plan is successful, India should have increasingly less sugar to export to the world market.

- The days of subsidised Indian sugar blanketing the market are over!

Other Insights That May Be of Interest…

The World Needs More Sugar…Who Can Help?

The World Needs More Sugar…Can India Help?

India’s Unknown Climate Heroes

Explainers That May Be of Interest…