Welcome to the second instalment of Czapp’s course on the futures markets.

In the first episode we looked at what futures markets are and what goes into a futures contract. In this second episode we look into how futures markets are used to facilitate global trade and how they can be used as an instrument to speculate on commodity prices.

In the final part of this series, we will look into the futures contracts used to buy and sell sugar.

Using a Futures Market to Mitigate Price Risk (Hedge)

Futures markets are most commonly utilized by participants solely as a tool for mitigating price risk, meaning the physical delivery of the commodity is organised separately, outside of the futures market. This is how a lot of global trade is facilitated.

In this instance the futures contract is used to hedge (protect) against adverse price movements in the physical commodity. Since the prices of the commodity in the physical market and on the futures market are correlated (though not perfectly):

The price risk of buying and selling on the physical market can be mitigated by taking out the opposite position on the futures market (buy physical, sell futures, and vice versa).

Cz works on behalf of both commodity producers and consumers to mitigate this price risk, granting our clients the opportunity to lock in a price they are happy with, at a time that works for them.

Typically, producers would look to fix a price when nearby prices are high, or lock in longer term coverage when the futures market is in contango (when the price is higher for contracts that expire further into the future).

Consumers would typically look to fix a price when nearby prices are low, or lock in longer term coverage when the futures market is in backwardation (when the price is lower for contracts that expire further into the future).

An Example of a Perfect Hedge

To explain how this process works let’s say you are a sugar producer (the process works just the same for a consumer as well).

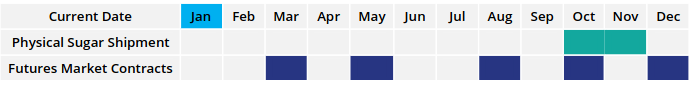

It’s currently January and you have 10k tonnes of physical sugar that you would like to sell for shipment in October-November.

Consumers might not want to contract your sugar this far into the future as they could lose out on the potential for buying sugar at a later date for a cheaper price.

Instead, you approach Cz to help facilitate the sale of your sugar. Cz will look at the futures market to find the closest futures contract to the shipment date that you would like, in this case the October futures contract. This contract gives you an opportunity to secure a sale at your desired price.

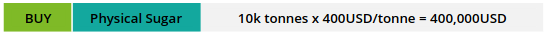

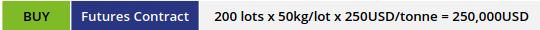

Using this, Cz agrees a fixed price that works for you to buy your 10k tonnes of sugar, let’s say we agree on 400USD/tonne.

Cz has now bought 10k tonnes of sugar that won’t be shipped for many months, this leaves us exposed to market fluctuations between now and the shipment date in October-November.

To mitigate this price risk, Cz will go to the futures market and sell 200 lots (1 lot is 50.8 tonnes) of the October 2022 futures contract, let’s say this was achieved at 350USD/tonne.

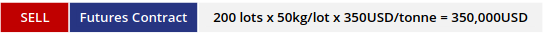

Fast forward to May, a buyer for the sugar you sold to us has become available. Consumer B would like to buy 10k tonnes of sugar for shipment in October-November.

Again, Cz would go to the futures market to find the most relevant futures contract for an October-November shipment date. This would still be the October 2022 futures contract, used for a reference price.

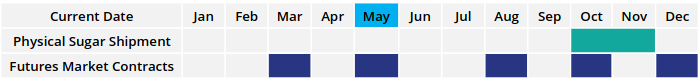

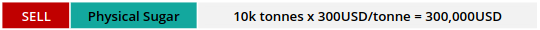

Prices have fallen since January, so Cz agree to sell the 10k tonnes of sugar to Consumer B at 300USD/tonne, a price that works for them.

Like before, to mitigate the price risk Cz will go the futures market and buy 200 lots (10k tonnes) of the October 2022 futures contract, since prices have fallen this was achieved at 250USD/tonne.

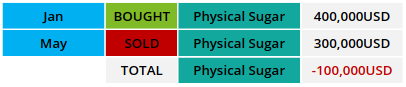

Therefore, had you waited until May to sell your sugar, since prices fell you would have lost out on 100USD/mt for the 10k tonnes of sugar you wanted to sell, that’s 100,000USD that could have gone uncaptured since you would have been exposed to the price fluctuations.

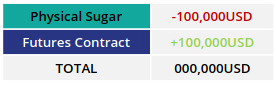

For Cz, by buying your sugar from you at 400USD/tonne then selling it a few months later to Consumer B at only 300USD/tonne we take that loss instead.

However, since Cz also took out the opposite positions on the futures market alongside the sales we made on the physical market, the situation is very different, the price risk has been mitigated (hedged).

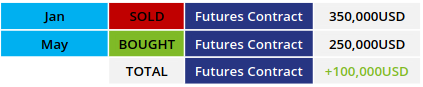

By selling 200 lots of futures contracts at 350USD/tonne, then buying 200 lots of futures contracts a few months later at 250USD/tonne Cz has made a profit of 100USD/tonne or 100,000USD on the futures market.

This completely cancels out the losses we made on the physical sugar delivery leaving Cz at breakeven, this is an example of a perfect hedge.

This means that since Cz can utilize the futures markets to mitigate the price risk of buying and selling physical sugar, you can lock in a price at a level you’re happy with, at a time that works for you.

Of course, by using the futures market in this way Cz must remember to close all futures contracts out before the expiry as to avoid having to deliver/receive the commodity through the futures market as well.

Using a Futures Market to Speculate

Futures markets are also used by financial entities to speculate (bet) on the direction of price movement of the underlying commodity in order to make a profit. This is a risk seeking strategy.

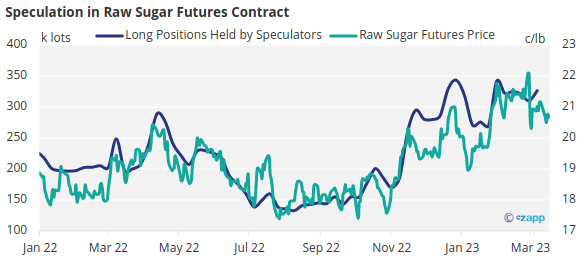

Speculators will use the futures market like a stock market, this can be observed by looking at the raw sugar futures prices and the number of long positions held by speculators in that contract, they are fairly strongly correlated:

The difference between speculation on a futures market and a stock market is that positions must be closed out before an expiry or rolled over to the next contract. A bank or hedge fund definitely does not want to have to deliver or receive any of the actual commodity!

One key benefit of speculative involvement on the futures markets is that it adds extra liquidity to the market. Greater liquidity means it is easier for buyers and sellers to open and close positions as there will be a greater likelihood of there being another participant willing to accept the price you would like.

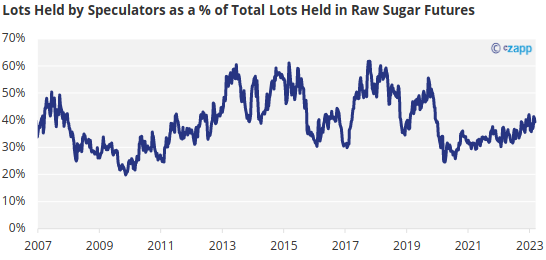

For the No.11 raw sugar futures market, speculators generally make up between 20% and 60% of the total lots held in the market.

Using a Futures Market to Deliver/Receive a Commodity

An exchange traded futures market was originally designed to allow a match-up between a pool of buyers and sellers to facilitate the physical delivery of the commodity to the receiver. However, participants using it this way now only account for a relatively small number of lots per contract.

It is thus a very secondary use of futures markets in reality, and only works for markets that are physically-settled, not for markets that are cash-settled.

Since the exchange acts as the counterparty, trades are not made bilaterally (directly between a buyer and a seller). This means that participants are able to lock in the price that they are happy with, but not who they trade with.

This works since the quality of the commodity is standardised within the framework of the contract so a buyer should be agnostic over who they receive from, at least in terms of the product received.

Since the counterparty is the exchange itself, this is a major advantage of using futures markets to facilitate the physical delivery of the commodity since it greatly reduces the counterparty risk. Buyers and sellers don’t have to worry about the reliability of whoever is on the other side of the trade.

Once the futures contract has expired the exchange will match up buyers and sellers based on a process called novation, and details of the futures contract will determine how that commodity should be transferred from seller to buyer.