The price of frozen concentrated orange juice (FCOJ) has risen to new highs in the past month but the commodity has always experienced volatility. We take a look at the factors that influence supply and demand and provide methods to manage price risk that stems from this volatility.

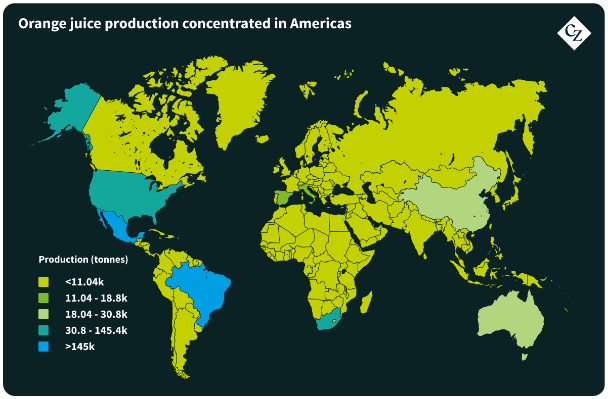

FCOJ Production Regions are Concentrated

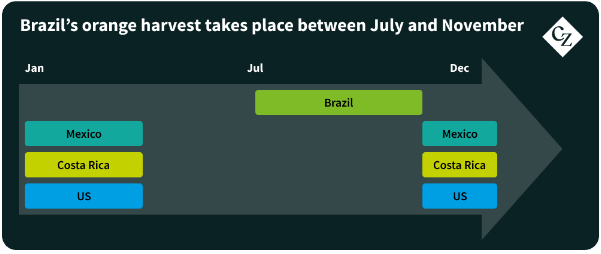

The global production of oranges for orange juice is extremely concentrated, with the majority taking place in the southern U.S., Mexico and Brazil.

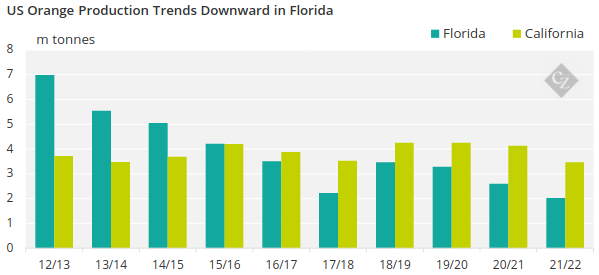

As a result of this concentration, the orange crop is particularly susceptible to adverse weather effects, with the most recent — Hurricane Ian — having affected Florida’s crop in late 2022. The hurricane was one of the costliest weather disasters on record to strike Florida and impacted orange production.

Source: USDA

There is also the risk of pests. The incurable HLB citrus tree disease reduces yield, causes premature fruit dropping and impacts the long-term health of the trees. As a result of these supply constraints, FCOJ futures have been trading at their highest levels in the past five years.

While weather has been generally found to be the biggest determinant of FCOJ prices, there are other issues to consider. For example, a huge amount of production is concentrated in Brazil, meaning any change in government policy related to trade, environment or agriculture is likely to have a significant effect.

FCOJ Can be Traded on Spot and Exchange Markets

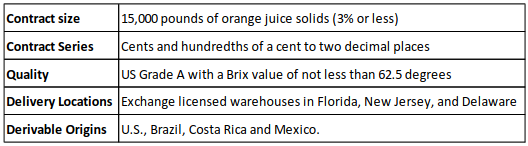

Like sugar and other soft commodities, FCOJ futures and options on futures are offered on exchanges, as well as the physical market.

ICE FCOJ-A Futures Specifications

Some of the contract specifications for this product are above. However, keep in mind that the product can be tailored to meet client needs.

FCOJ is unique in that it is the only product of its kind that is offered on the exchange market, meaning those trading the commodity can obtain greater protection from price risk.

How Hedging Can Help

It is important to keep in mind that CZ has two kinds of FCOJ clients: producers and consumers. The former supply the market with the commodity, and they desire price increases so that they can generate profits by selling at higher levels. On the other hand, consumers look to buy the commodity, so lower prices are more beneficial to them.

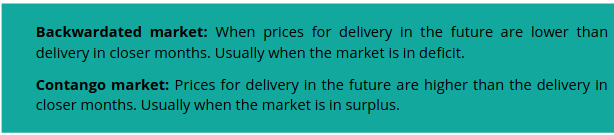

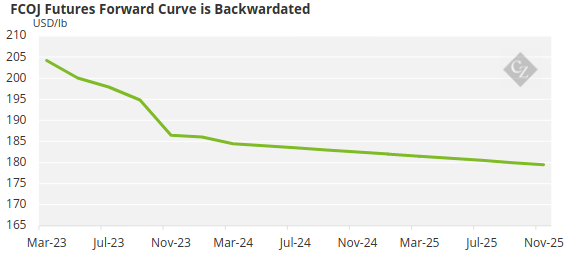

To achieve the best result for both parties, CZ needs to manage the risk of price changes in the derivative market by buying and selling FCOJ and FCOJ futures. Right now, the forward curve shows that we are in a backwardated market, meaning the price in the future is lower than the current price.

In this scenario, FCOJ producers might either be incentivised to sell at a spot price or sign a long-term contract to sell in the future. When the supplier is ready to sell its physical product CZ will buy it at the supplier’s preferred price. And as CZ is an entity authorized to trade derivatives, we will hedge the contract by simultaneously selling a corresponding number of futures

FCOJ consumers will conversely be incentivised to defer their purchases and buy at a future price when the market is backwardated. CZ will buy the futures and issue a contract stipulating that it is selling the client FCOJ for the forthcoming months at a specific price. This means that, if the physical price increases, the client will not see any material financial impact.

Protection Against Price Rises Also Available

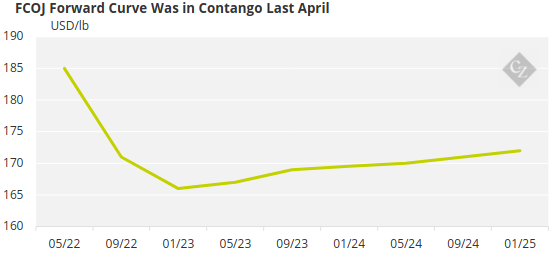

The opposite of a backwardated market is a contango market, where the future price of a commodity is expected to be higher than the spot price. This is what happened in April 2022.

In this instance, it would be more favourable for the producer to sell at the Apr’22 spot price of USD 186 per pound since it looks like the future prices might be lower. CZ can buy this physical contract, mitigating the risk that the prices become too low for the client.

On the other hand, the processor needs a shipment for Feb’23 and can obtain a FOB price of USD 167 per pound on the futures market, as can be seen in figure 5. If the client had instead waited and bought at the spot price, it would have paid a FOB price of USD 242 per pound, which could drastically affect profitability.

Hedging Helps Manage Volatility

Considering this volatility in the market, both producers and buyers could protect themselves by hedging on the derivatives market, using tools such as futures. Like sugar, FCOJ future contracts are physically delivered, and the prices change daily according to market fluctuation and seasonality.

This means the derivatives desk can act as a buffer between CZ clients and the fluctuating physical prices, therefore allowing CZ clients to be price makers instead of price takers.

Regardless of whether the market is bullish or bearish, CZ can constantly monitor the market and its fundamentals to help clients to understand the market according to their business needs and make the best decisions.