Futures market play a crucial role in managing price risk for commodities. While PET resin itself does not have a traded futures contract, its two main raw materials, PTA and MEG, are actively traded on futures exchanges. CZ assists clients in managing future price risk exposure for commodities, including PET resin, through its coverage and analysis of PTA and MEG futures prices.

What are Futures Markets?

Most major global commodities are now listed on futures exchanges or futures markets, with prices for delivery at specific points in time traded frequently and transparently by market participants.

Many physical supply contracts now relate directly to these futures markets, allowing commodity buyers and suppliers the ability to independently hedge their market exposure.

CZ helps clients manage future price risk exposure for commodities, including PET resin, several years in advance of shipment; this is made possible through executing coverage on futures markets.

PET Resin and Raw Material Futures

As a major commodity plastic used across the food and beverage industry, it may come as a surprise that bottle-grade PET resin does not yet have its own traded futures contract.

As PET resin does not have a transparent futures contract, managing price risk can be difficult. Supplier pricing can move aggressively and at short notice, and often it can be difficult to negotiate prices even more than a few months in advance of delivery.

Although lacking a PET resin futures market, the two main raw materials used in its production, purified terephthalic acid (PTA) and monoethylene glycol (MEG), do have their own traded futures contracts.

PET Molecules

PTA was listed on China’s Zhengzhou Commodity Exchange (ZCE) in 2006, whilst MEG futures were only recently launched in 2018 on the Dalian Commodity Exchange (DCE).

PTA and MEG futures are traded domestically in China and denominated in Yuan.

Breaking Down PET Resin’s Cost Structure

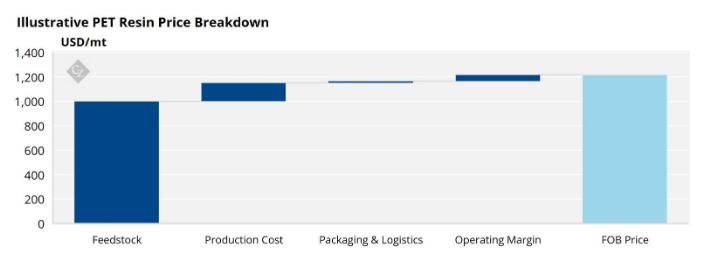

Raw material costs represent around 80% of the total overall production cost for PET resin, making them a major component of its market price.

By using the individual PTA and MEG futures prices, as well as factoring in their consumption requirements in the production of PET resin, a raw material futures cost can be assumed.

Comparing this feedstock cost to the current physical PET price, we can also assess the differential being charged for the product.

This is typically how markets operate in other commodities, where the producers negotiate pricing at a differential to the respective futures market.

Through reverse engineering the PET resin price, we can see whether the differential is historically high or low, and whether contracting now is a good sourcing decision, even in the absence of an official PET resin futures market.

Analysing the Physical Differential

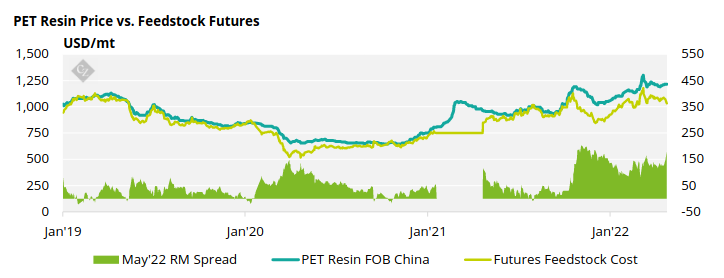

The chart below shows the historical difference between the physical PET resin export price and the cost of raw materials based on their individual futures prices, having been converted into USD.

The difference between PET resin’s export price and its feedstock costs is shown as the shaded area at the foot of the chart. This becomes the ‘physical premium,’ the value for which is shown on the right chart axis.

This chart is part Czapp’s PET Raw Material Futures Insight, published each week and outlining the fundamental outlook for PTA and MEG futures, as well as the PET resin physical premium.

Here, we break down the key constituent parts of the final price, explaining how each has moved and whether that has affected the final price for PET.

How CZ Can Help Buyers?

In today’s volatile environment, increased fluctuations in commodities prices can erode margins.

PET resin buyers must rethink their approach to price risk management to protect margins and help beat the competition.

CZ is able to lock in PET resin market coverage for clients without committing tonnage with a physical supplier, embedding pricing into a physical contract.

This avoids the requirement of margin or deposit payments and reduces the need for hedge accounting.

This also allows our clients to retain the same amount of flexibility that can be expected when trading other physical commodities, such as sugar, grains and dairy.

For PET hedging enquiries, please contact the risk management desk at MKirby@czarnikow.com.

For research and analysis questions, please get in touch with GLamb@czarnikow.com.