Carbon compliance markets are legally binding systems that seek to drive emissions down by putting a price on emitting greenhouse gases into the atmosphere.

The most common compliance market is known as “cap-and-trade”, in which the regulator sets a limit on the total amount of CO2 that can be emitted by covered entities – factories, power plants, energy distributors, etc.

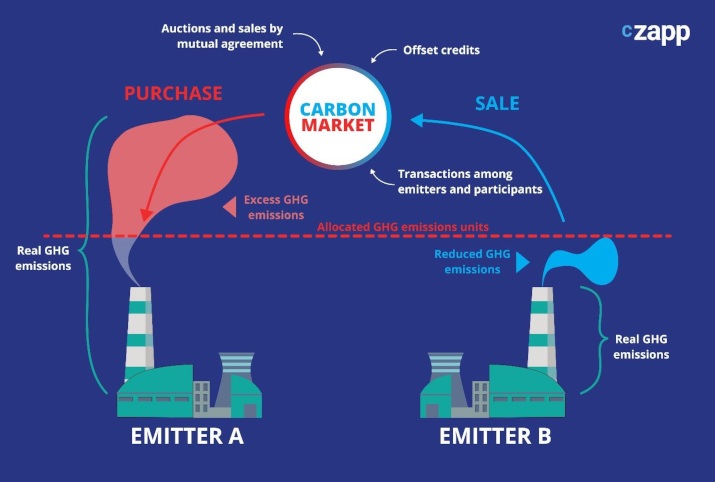

This limit, also known as the “cap”, is then represented by a number of carbon allowances or permits that are auctioned or distributed free of charge to those entities. Each allowance represents the legal permission to emit one unit of carbon dioxide.

At the end of the control period (normally one year), emissions from each installation are measured, verified and reported, and the operators are required to surrender an equivalent number of allowances to the regulator.

Financial penalties are imposed on those participants that fall to surrender permits matching their emissions. In Europe’s emissions market, for example, this penalty is set at €100/tonne in addition to the surrender of any missing permits.

Emitters judge whether it is cheaper for them to invest in reducing their own emissions, which reduces the number of emissions allowances they need to buy, or whether it is cheaper to buy allowances in the open market and surrender those.

Companies that reduce their own emissions can then sell their surplus allowances, while those that choose not to reduce must buy. The operation of the market is often enhanced by third parties, such as exchanges, banks, trading houses and investors who provide price transparency and liquidity.

The price of carbon is set by the tension between a steadily falling supply of allowances, and declining demand as more and more emitters take steps to reduce their own emissions. As supply and demand do not change at the same pace, prices will move to reflect their relative strength at any given time.

The goal of a cap-and-trade system is eventually to reduce the limit on emissions to zero, so that the market is no longer necessary. The regulator steadily reduces the overall cap over time, which in turn increases the scarcity of allowances and drives the price higher.

In turn, the rising price of carbon allowances means more expensive emissions reductions become economically feasible and this enables more companies to reduce their CO2.

The development of a financial market around the cap-and-trade system has enabled market participants to develop tools to manage risk. Futures and options contracts allow producers to hedge their carbon exposure several years into the future, while more tailored solutions allow smaller participants to engage with the market even when they lack the resources to become exchange-admitted traders.

Carbon markets can also be extended to cover additional sectors of the economy. The European Union is presently debating whether to bring maritime shipping into its existing emissions trading system, as well as launching a separate carbon market to cover CO2 from transport and domestic fuels such as natural gas.

A number of jurisdictions operate different versions of “cap-and-trade” markets to drive down carbon. China’s first phase of its national emissions market sets a limit on emissions per unit of output, rather than a cap on overall emissions.

This means that as long as a covered entity can keep its CO2 emitted per unit of output under the regulated limit, its total emissions can continue to climb.