Welcome to the first instalment of Czapp’s course on the futures market.

In this episode we will look at what futures markets are and what constitutes a futures contract.

In the upcoming second and third episodes we look into how futures markets are used to facilitate global trade and dive into the specific futures contracts used to trade sugar.

What is a Futures Market?

A futures market allows participants to buy or sell a specific volume of a particular commodity at a predetermined price for delivery at a specified time in the future.

The market for each commodity will have a set of strict regulations on quality to ensure only valid goods can be traded.

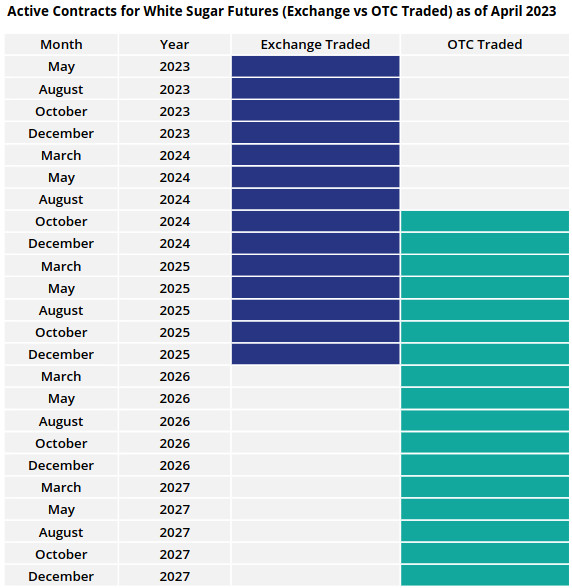

Trades are priced using futures contracts which are traded on a futures exchange (centralized) or through forward contracts often as Over-the-Counter (OTC) deals directly with financial institutions (decentralized).

On a centralised exchange, the exchange acts as the counterparty for long (buy) and short (sell) positions. This helps reduce the counterparty risk for all participants in the event of a default.

Trades within an OTC market are instead directly between two parties, rather than via a broker or exchange. Typically, they are less transparent, less liquid, and subject to fewer regulations than centralised exchanges.

For sugar and similar commodities, they can be offered by banks and are used to offer price risk management opportunities further into the future than contracts available on a centralized exchange.

For white sugar, OTC traded contracts can be available around up to two or three years further out than the equivalent exchanged traded contracts.

At Cz we execute using a combination of both methods, giving you and your business optimal price risk management.

Additionally, all derivative cover with us is embedded into a physical contract, this allows you to avoid many of the costs associated with trading on a futures market on your own account, we will explain this in more detail later on.

What Does a Futures Contract Look Like?

The futures contract tells you what each lot (the unit contracts are traded in) represents. This includes the size of the lot (in tonnes, kg, etc.), the quality requirements of the product, and when the delivery window for exchange of goods will open and close (contract month).

Since a futures contract is a financial contract whose value is derived from an underlying commodity it is classified as a derivative.

These contracts are either settled with cash or settled with the physical delivery of the product.

In general, exchange traded futures contracts are listed against a month of the year, each with its own code:

Combined with the year this gives the contract its name, for example the May 2023 contract would be called K’23. This determines when the contract will expire and when the delivery window for the physical good opens.

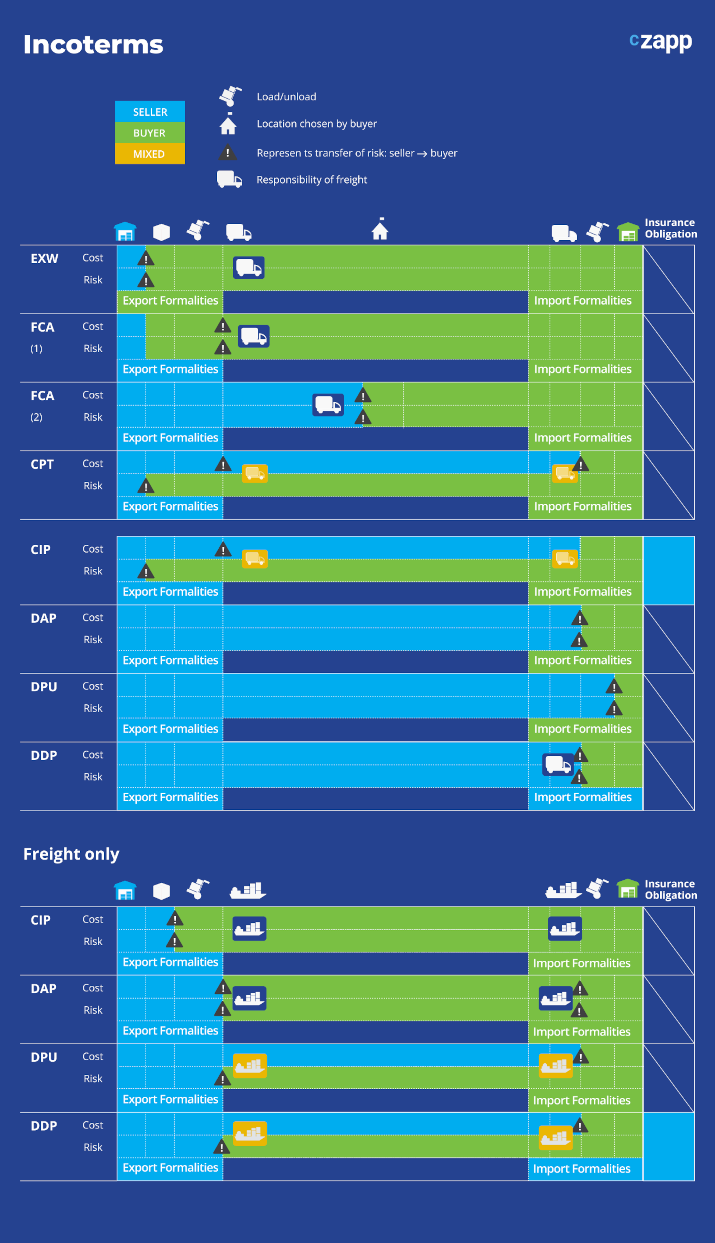

Also built into the contract is the point at which the risk transfers from the seller to the buyer, standardised according to the international recognised incoterms. Transfer of risk can occur as early as the goods leaving the sellers warehouse (ex-works), or as late as once the goods arrive at the buyers warehouse (delivered duty paid).

A common incoterm for commodities like sugar is free-on-board, FOB, this means the seller’s risk ends once the goods are passed over the rails of the ship at the port of origin. Here’s a list of others:

Finally, the futures contract would outline how the commodity should be packaged for transfer (e.g in double lined Poly-propylene bags), what type of vehicle/vessel it should be loaded onto (e.g a breakbulk vessel), and any other requirements surrounding the loading/discharge of the vessel (such as achieving a minimum load rate).

How Futures Market are Accessed

There are a number of brokerages that provide market access, allowing clients to open an account to trade on a futures market, for a fee. Clients would need to sign an ISDA (International Swaps and Derivatives Association) agreement with one of these companies, ISDA provides a standardized agreement for entering into a derivatives trade.

Clients trading on their own account would also need to manage broker line availability, paying margin calls and undertaking full hedge accounting if required.

As we will outline in more detail, pricing embedded into a Cz physical contract gives you full market access without the limitations of the above.

If you cannot open an exchange traded account, then there is the option to use an OTC account instead. This is generally more flexible however you would have to pay more for the market access.

What are the Typical Costs?

Like other financial instruments, futures markets operate with leverage, using borrowed money to control larger positions than would be possible without.

Futures contracts are traded using leverage called ‘margin’. Margin is leverage deposited with the brokerage in order to cover the risk the broker is exposed to by opening a trade on behalf of the client. The amount deposited should cover a percentage of the market price when the trade is made.

Once the trade is open, the client will then have to pay any margin calls if the futures market price begins to differ significantly from the price the trade was locked in at.

Margin calls occur if the futures price falls too far below the price a long position was opened at, or too far above the price a short position was opened at (i.e. in a losing trade), then the value of the margin paid into the margin account will fall below what the broker requires. This will require the margin account to be topped up.

When a client trades futures on their own account they will also have to take the mark to market (a means of valuing assets by their most recent market price) on their hedge positions every month as profit or loss.

This isn’t great if you are using the futures market to price risk manage (hedge) a physical commodity years ahead of time.

Hedging with Cz

For clients of Cz these futures contracts are embedded into a physical contract, this means we help our clients avoid needing to account for the profit or loss on their futures market hedge.

Additionally, by using a Cz futures account clients don’t need to worry about having sufficient cash to cover their hedges as all margin calls are covered by Cz.

We also don’t charge commission payments on the initial trade or when rolling (repositioning) positions. For some more complex spread trades this can amount to up to 40c/mt on a single execution.

All of our pricing is sourced using a strategy that is optimal for your business. Whether we execute using the futures market trading an exchange trade derivative, through one of our many bank relationships as OTC, or create a position for you as a bespoke trade, you can be certain you have obtained the most efficient pricing in the market.

Please contact Max for more details.

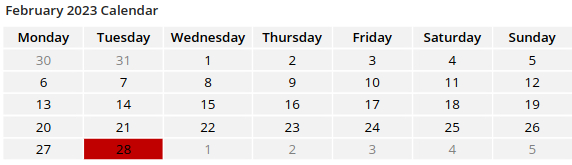

However, No.5 refined sugar contracts typically expire 16 days before the contract month.

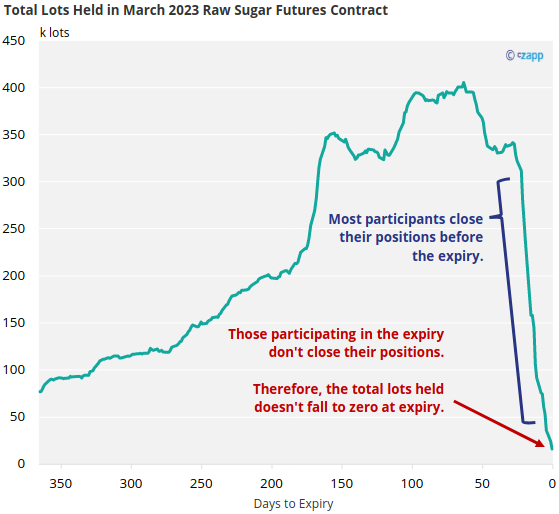

Once a futures contract has expired only those who wish to deliver or receive the commodity through the exchange should still have open positions. Those who wished to use the futures market to hedge the trade of the commodity outside the exchange, or those looking to speculate on the price movement of the underlying should have closed all positions in advance of the expiry.

This is why most positions are closed out before an expiry.

As such, all positions that Cz undertakes in the futures market related to pricing embedded in physical contracts are closed before contract expiry.

We typically ask that all pricing orders are concluded at least two weeks before the expiry date. This is because as participants close their positions volatility in prices increases. This is due to a lack of participants needed to trade.

Concluding all pricing at least two weeks before expiry ensures that our clients avoid this volatility caused by a reduction in liquidity.

Once a contract has expired, the exchange matches up all remaining long and short positions to determine the volume of commodity needed to be delivered and how the goods are transferred from the sellers (deliverers) to the buyers (receivers), this is achieved using a process called novation.

Since the quality of the commodity should be within the specification of the contract, buyers can receive from a variety of sellers and a seller may have their commodity delivered to multiple buyers if the novation process produces this as the best solution.

The contract will also specify how long after expiry the deliverer has to make the commodity available to the receiver, and where it must be made available, depending on the incoterm.

For example, the No.11 raw sugar contract requires the deliverer to make the sugar available at an authorised port since it is an FOB contract, within 75 days of the contract expiring.

The contract may also stipulate a minimum rate of loading that needs to be achieved, what type of vessel it is to be loaded onto, and how the commodity is packed.

Once the risk has transferred to the receiver the delivery process is considered complete, and final delivery to the buyer’s warehouse/factory is up to the buyer.