Carbon offsets are the ‘visible’ outcome of an investment project that replaces existing fossil-fuel or carbon-intensive processes with clean, low- or zero-carbon alternatives, or which absorb CO2 from the atmosphere.

They are generated after a process of monitoring, reporting and verification of the emissions reduced by the project, whether it’s a forestry project, a wind farm or an initiative to distribute clean and efficient cookstoves in developing countries.

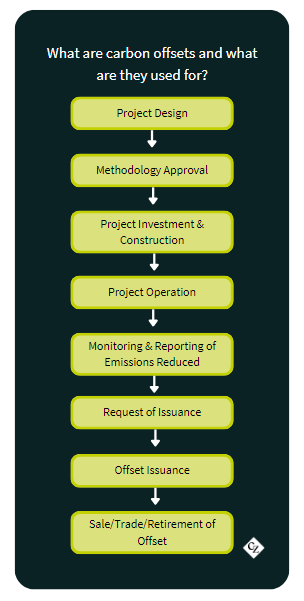

Each project needs to follow an established methodology to calculate what the emissions would be without the project taking place, and then to calculate how much carbon dioxide has been saved, stored or avoided by the project’s implementation.

These methodologies are maintained and supervised by offset standards organisations like Verra or The Gold Standard, who constantly update them and issue new methodologies as different types of projects are developed.

These methodologies cover many aspects of the investment itself, as well as the rules for calculating emissions reductions. For forestry projects, for example, the methodologies may require consultation and approval from indigenous populations, while other methodologies could require local government planning consent.

Methodologies also set rules to decide the “additionality” of the project, that is, whether the project is reducing emissions faster than a business-as-usual scenario. For example, renewable power is now competitive with fossil fuel-fired power in many parts of the world, and so solar and wind generation projects are no longer seen as “additional” in many countries.

Once a project is up and running, the project owner or investor must engage an independent auditor to monitor and record the progress of the project, known as MRV – monitoring, reporting and verification.

If it’s a wind farm, for example, the auditor has to verify how much electricity is being generated and therefore how many tonnes of CO2 are being avoided compared to a fossil fuel-fired power plant.

If it’s a forestry project, the auditor has to verify that the forest cover has not been reduced and measure the growth of trees to calculate the amount of CO2 that’s been stored.

It is the project owner or investor’s task to ensure that the auditor’s MRV report is forwarded to the relevant offset standard, along with a request that the relevant number of offsets are issued to the project.

Issuance of the offsets is made into a registry account, held by the project owner or investor, at which point the offsets can be retired immediately to neutralise a carbon footprint, or they can be sold to another entity and/or transferred to another registry.

Each offset represents one tonne of emissions reduced during a particular period, which is often referred to as a “vintage”, but there are additional features of carbon credits that can be taken as quality differentiators.

Many carbon offsets don’t just represent one tonne of CO2 reduced. Increasingly, credits are also “tagged” with sustainable development goals such as avoiding poverty, promoting education and health, reducing inequalities or preventing hunger.

As a simple example, a project to distribute efficient cookstoves in Africa can support a number of the UN’s Sustainable Development Goals (SDGs).

By replacing the need to collect firewood for cooking with clean, efficient domestic stoves, a project can claim to meet at least six SDGs by allowing children to attend school rather than harvest wood, improve health by removing harmful woodsmoke from homes, help reduce poverty and hunger, provide affordable and clean energy and enable more women to seek employment.

Offsets tagged with SDGs can often achieve a premium to the general market as purchasing companies may seek to associate themselves with the development goals, while prices also vary quite widely depending on the project type, location and offset vintage.

When a buyer wants to use a carbon credit to offset its emissions, it retires the offset in the registry. “Retirement” is a process that simply tags the offset as having been retired, so that it cannot be re-sold or re-used. The credit is then transferred to the registry’s retirement account, and can be said to no longer exist.