Insight Focus

Market chaos and a collapse in crude oil prices led to a PTA and PET futures rout. Chinese PET resin export prices dropped around USD 40/tonne to new post-Covid lows. Further PET price weakness may prevail as wider spreads are unsupported by fundamentals.

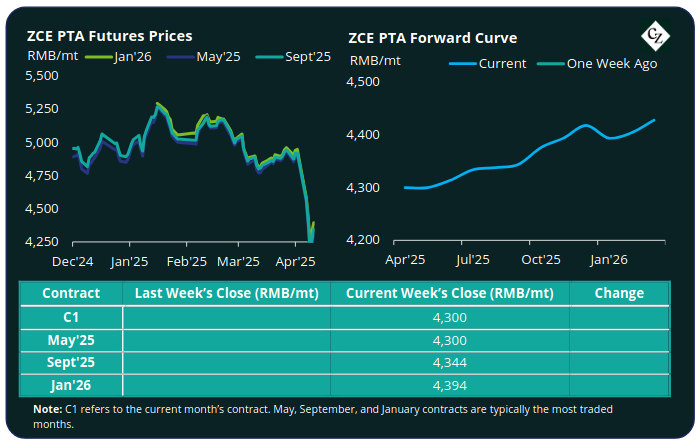

PTA Futures and Forward Curve

PTA futures were down around 11% on average versus the previous week’s close on Thursday due to the Tomb Sweeping holiday.

Oil prices dropped sharply last week amid escalating US-China tariff tensions with fears of a global recession weighing heavily on market sentiment. By end of day Friday, Brent crude oil prices settled around USD 64.80/bbl, down from over USD 67/bbl a week earlier.

Both PX and PTA fundamentals saw limited change amongst the wider market chaos. However, some PTA plant maintenance meant overall operating rates reduced whilst high polyester run rates continued to support demand.

The PX-N CFR average weekly spread narrowed by nearly USD 30/tonne. Meanwhile, the PTA-PX CFR spread improved to average of USD 82/tonne last week, up USD 6/tonne on the previous week.

The PTA forward curve is now in slight contango due to the sudden near-term falls the market has experienced. The Sept’25 contract holds a RMB 44/tonne premium over May’25.

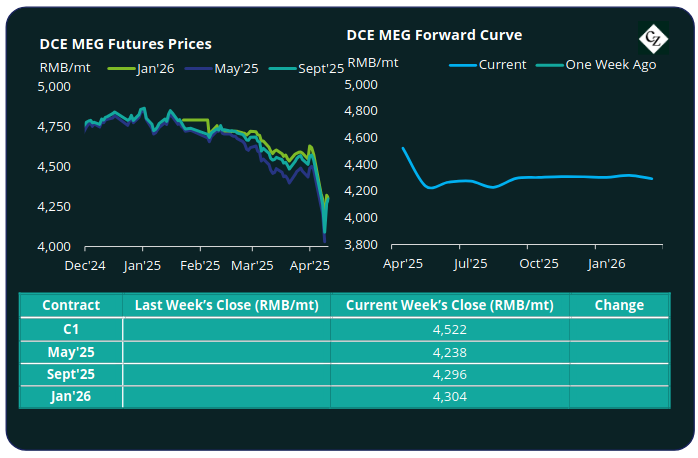

MEG Futures and Forward Curve

MEG Futures contracts also tumbled with main month contracts down over 5% versus the pre-holiday close the week prior.

East China main port inventories decreased by 5.3% to around 673,000 tonnes following reduced import arrivals and a rebound in offtake.

While improved polyester sales supported MEG from the demand side, in the longer term, the downstream textile industry is likely to be impact by the latest US tariffs, leading to some more cautious buying by traders.

Beyond the current month’s contract that is coming to a close, the MEG Futures forward curve remains relatively flat/slight contango. The Sept’25 contract is at a RMB 58/tonne premium over May’25.

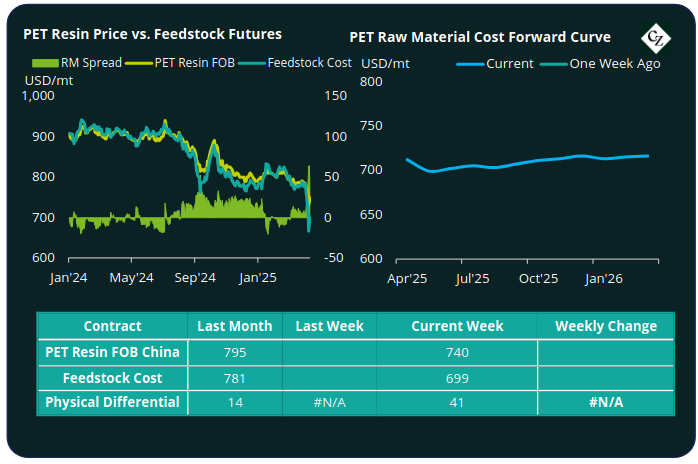

PET Resin Export – Raw Material Spread and Forward Curve

Chinese PET resin export prices fell to an average of USD 740/tonne FOB China by Friday, down USD 40/tonne on the previous week. Despite producers trying to move pricing higher, prices were beat back down.

The average weekly PET resin physical differential against raw material future costs leap to a 12-month high of a weekly average of positive USD50/tonne last week, up a massive USD 44/tonne. By Friday, the daily differential was positive USD 41/tonne.

The raw material cost forward curve remains relatively flat, with Sept’25 at a USD 8/tonne premium over May’25, and Jan’25 holding just a USD 14/tonne premium over Sept’25.

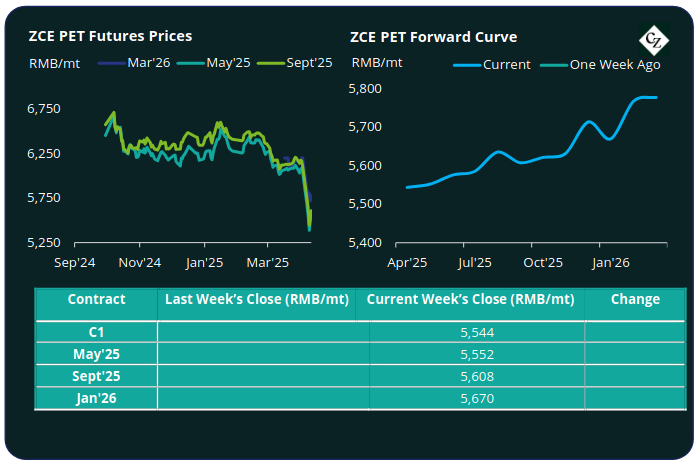

PET Resin Futures and Forward Curve

PET resin futures also fell sharply with main contract months down a further 8% on the week.

May’25, the current main month with the highest liquidity, fell 8% to RMB 5,552/tonne (USD 759/tonne), down around USD 70/tonne from last Thursday’s market close.

The average weekly premium of the May’25 PET futures over May’25 raw material futures increased to USD 30/tonne, up USD 12/tonne. By Thursday, the daily premium was USD 32/tonne.

The PET resin futures forward curve kept relatively unchanged in shape. Sept’25 held a RMB 56/tonne (USD 8/tonne) premium over May’25.

Concluding Thoughts

The huge weekly rise in PET resin physical differential over raw material futures is not supported by fundamentals. As a result, a rebalancing in pricing is likely as and when upstream volatility subsides.

While bottle-grade resin demand has improved with seasonality, demand typically softens beyond May. The added uncertainty with global commodities is likely to led to more cautious purchasing.

With a forward premium of less than USD 10/tonne, PET resin pricing will almost exclusively be driven by the fortunes of the global crude markets over the next six months.

Close attention should also be paid to changes in ocean freight rates. A downward correction in the global economic outlook and disruption in trade volume may help soften freight rates on certain lanes. However, carriers are ever adept at seizing every opportunity to increase rates.

For PET hedging enquiries, please contact the risk management desk at MKirby@czarnikow.com.

For research and analysis questions, please get in touch with GLamb@czarnikow.com.