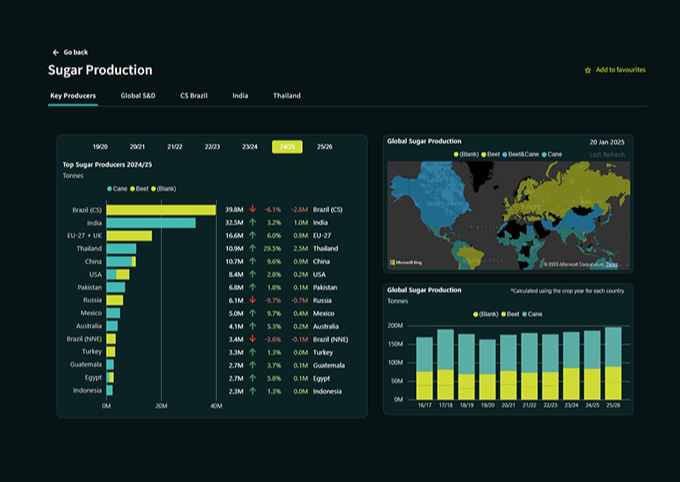

Sugar Futures Prices Overview

For professionals in procurement, commodity trading and market analysis, timely and accurate data is essential.

Our platform offers comprehensive insights on raw sugar and white sugar market prices, as well as extensive data and analysis compiled by industry experts, helping you to make sense of what’s happening.

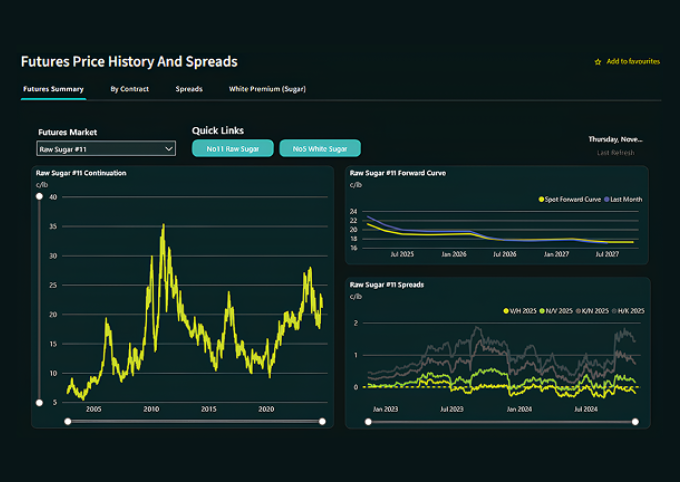

We have 15-minute delayed prices for ICE markets, New York No.11 raw sugar futures and London No.5 white sugar futures included in a premium subscription.

Find out more

Sugar Futures Prices and Commentary

Read our expert analysis on price drivers and trends. Our articles are written by industry experts to provide you with concise, data-backed opinions on the market.

Raw Sugar Update

A mixed opening saw May’25 wipe out most of its initial gain and slip back to 18.69, however the early strength then resumed with May’25 pushing ahead to 18.90 to sit back within proximity of this week’s highs. Trading then quietened considerably for the rest of the morning as a consolidation pattern developed, and this in turn provided the platform for additional gains to be made as the afternoon developed. On the first attempt higher this only resulted in reaching 18.98 to remain a small distance short of the 19.04 weekly high, but following another period of consolidation the market gathered itself to push again and, on this occasion, extended through 19.00. Much of the buying came from smaller traders / specs with them filling in some assorted producer pricing as May’25 reached to 19.12, but though they continued to support the price above 19c into the final hour that proved to be the extent of the gain. Until the final 15 minutes the market looked set for a psychologically positive close above 19c, however the necessity for day traders to close out longs ahead of the close sent the price back into the range and resulted in a close at 18.86. In context of the day this was a disappointing finish which does little to change the technical picture, though it does at least negate yesterday showing and suggest that we are unlikely to see a quick return to the lows.

White Sugar Update

Yesterday’s lethargic performance was quickly forgotten as opening buying took May’25 back up into the lower $530’s and re-establish some of the positive momentum from the start of the week. The movement did stall ahead of $535.00 where some better scale selling started to be seen, and the market became quite calm with a narrow band prevailing through into the afternoon on low volume. The higher levels were allowing for some recovery in the spread and arbitrage values, although these were to pick up further when the market finally found some renewed buying interest during the three hours. Aided by some spec buying May’25 pushed through to $540.00, marking its highest value of the current recovery to improve the technical picture once more. May/May’25 traded up around $118.00 with the May/Aug’25 spread reaching $19.00, although neither was able to maintain these highs to the end of the session due to spec liquidation across the final stages. May’25 slipped back to settle at $533.20 with the spot selling sending May/Aug’25 back down to $16.00 and provide a more neutral end to what was an otherwise quiet, but generally positive session.

Live Sugar Futures Prices When

You Need Them

You need timely and accurate data. We offer you a

choice of live or nearly live sugar, coffee and cocoa

futures prices available as part of your subscription or

as a stand-alone license. Accessible via our desktop

and mobile app, you will have access to our live prices

on the go, wherever you need them.

Find out more

Sugar Market Insights & Expert Analysis on Trends

Read our expert analysis on price drivers and trends. Our articles are written by industry experts to provide you with concise, data-backed opinions on the market.

TechCom Forex Review Wednesday 3rd May 2023

Every effort has been made to ensure accuracy but no guarantee is offe...

EU Carbon Prices Jump as Commission Delays Additional Permit Supply

Insight Focus Fewer European carbon allowances in the market in 2023. ...

CS Brazil: Sugar or Ethanol? 03rd May 2023

This report is updated weekly, for daily information refer to our Inte...

Daily Market Price Updates and Commentary 2nd May 2023

Yesterday saw the first significant retracement of the market in weeks...

TechCom Core Commodity Review Tuesday 2nd May 2023

Every effort has been made to ensure accuracy but no guarantee is offe...

Sugar Futures and Market Data: 2nd May 2023

Insight Focus No.11 May’23 futures contract expired at 26.99c/Ib...

Why Freight Rates Won’t Face Another 10-Year Plateau

Insight Focus The freight market has gone through a bumpy few years. A...

NOLA/US Urea Prices Reach 2023 Highs

Insight Focus Ammonia settlement for may delivery to tampa down anothe...

Daily Market Price Updates and Commentary 1st May 2023

Sugar No.5 market closed due to Labour day holiday.

Daily Market Price Updates and Commentary 28th April 2023

A mildly higher start ensures that the market remains positive, howeve...

Ask the Analyst: Why Haven’t Thai Mills Started Hedging for 2023/24?

Insight Focus Thai mills have not started hedging for 2023/24 season. ...

Daily Market Price Updates and Commentary 27th April 2023

Jul’23 slipped back to 25.55 as we opened today, however the lows we...

CZ Explains

Your Guide to Understanding

the Sugar Market

Our explainers give you the information you need to

understand the sugar industry and sugar prices. These

guides are written by industry experts to help you build

your knowledge fast.

Subscribe to Alerts