- Chilean sugar demand is recovering as COVID restrictions ease, and more people are vaccinated.

- However, it’s struggling to import sugar, thanks to a wide array of logistical issues.

- Its domestic prices have jumped to a five-year high in response.

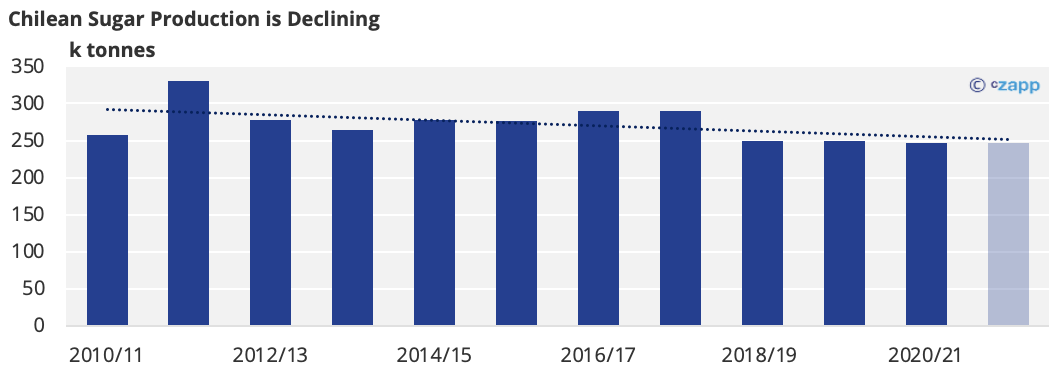

Chilean Sugar Demand Recovers Whilst Production Dips

- Chilean sugar demand is recovering as COVID restrictions ease, and its vaccination effort continues.

- However, its production has been declining since 2011/12, when two of its three beet factories were forced to close when running costs became too expensive.

- Its production should only decrease further as the Government strives to be Carbon Neutral by 2050.

- We currently think the country will have 488k tonnes less sugar than it needs to satisfy domestic demand in 2021/22.

- This is not unusual; Chile often has around 520k tonnes less sugar than it needs to satisfy demand each season.

- However, this season, it’s struggling to import sugar to fill the void.

Truck Drivers’ Strikes Limit Sugar Imports

- Chile imports around 130k tonnes of sugar from Argentina each year.

- With most of Chile’s demand centred around urbanised Santiago, it’s cheaper to move Argentinian sugar by truck than it is to produce sugar in-country.

- However, this is not an option at present as there haven’t been many truck drivers in Argentina or Chile this year.

- Drivers in both countries went on strike earlier this year, unhappy with their working conditions through COVID.

- With gasoline prices rallying as well, the drivers are asking for more money and freight costs have climbed further as demand intensifies.

- For context, there has been between 10,000 and 20,000 fewer trucks drivers in Chile alone this year.

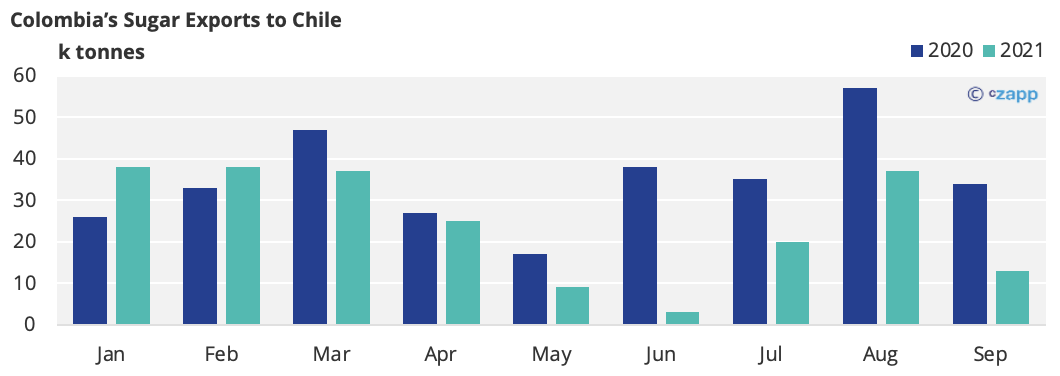

Maritime Logistics Are Also Causing Problems

- It’s worth noting that Argentina is not Chile’s sole option.

- Chile imports around 370k tonnes from Colombia and Peru each season.

- However, Colombia’s sugar exports to Chile are already down 94k tonnes year-on-year (30%).

- Peruvian exports to Chile are also down.

- In both cases, imports are down, not only due to high freight costs, but because workforces at ports have reduced through COVID, leading to vessel delays, blank sailings, and export caps.

- The present lack of containers also means sugar is being stored in warehouses whilst suppliers try to secure vessels.

Domestic Prices Rise as Supply Tightens

- Chile’s sugar prices are approaching five-year highs as the country struggles to secure supply.

- It’s not just sugar being affected, though.

- Prices for 43 of the 76 food products Chile imports have increased.

- The price of all products combined has increased by 4.5% in 2021, which means they are the highest they’ve been since March 2016.

- It’s not yet clear when prices will ease, but we fear today’s inflation could prolong the situation.

- If this is the case, Chile’s demand for sugar and other food products could reduce.

Other Insights that may be of interest…

What’s Really Happening in the Container Market?

High Freight Rates Until 2023?

Explainers that may be of interest…

Czapp Explains: The Chilean Sugar Industry