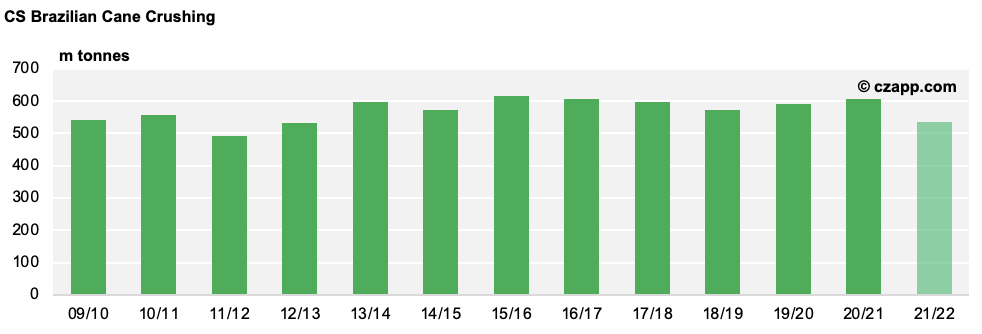

In case you missed it, we think Brazil will produce 534.8m tonnes of cane in 2021/22. This is a 70.7m tonne reduction year-on-year and Brazil’s weakest crush since 2012/13.

Last year’s drought seriously hindered cane development, leaving the mills with less to process this season than they’d like.

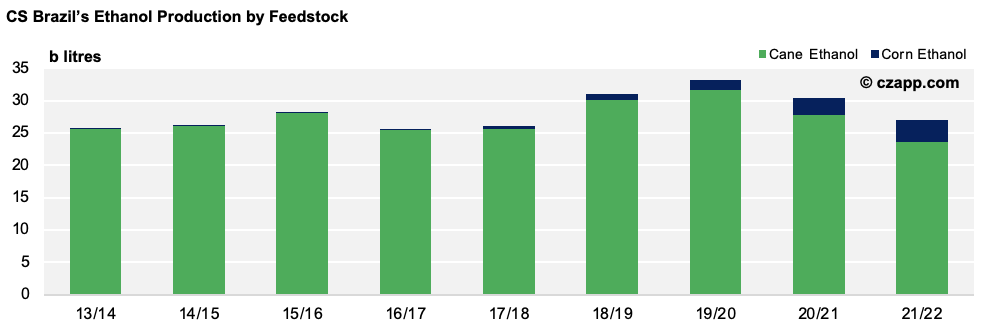

Ethanol should feel the brunt of this, as most of the cane was already priced for sugar production prior to harvest.

With this, cane ethanol production could be at its lowest point in a decade.

All eyes are on corn ethanol production as a result. As it stands, we think corn ethanol will occupy 10% of Brazilian ethanol production this cycle.

This may not mean all that much for the sugar industry, as no cane has been allocated to ethanol at the expense of sugar. Any losses the sugar producers have endured come from the poor crop alone, rather than heightened ethanol production following the poor harvest.

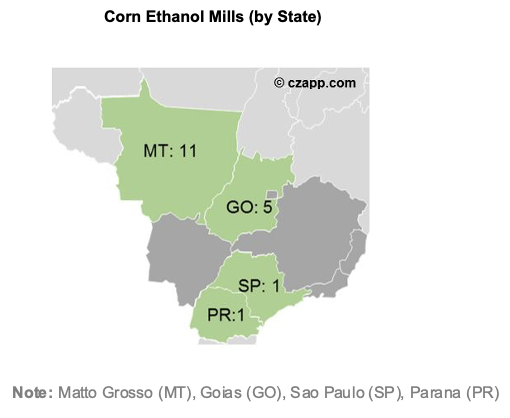

Additionally, the majority of corn mills (either full mill or flex) are located in Mato Grosso (MT), which is more focused on grains rather than cane, reducing the need to compete for area.

Other Opinions You Might Be Interested In…

Explainers You Might Be Interested In…