For this question, it’s important to focus on India, Thailand, the EU, and China.

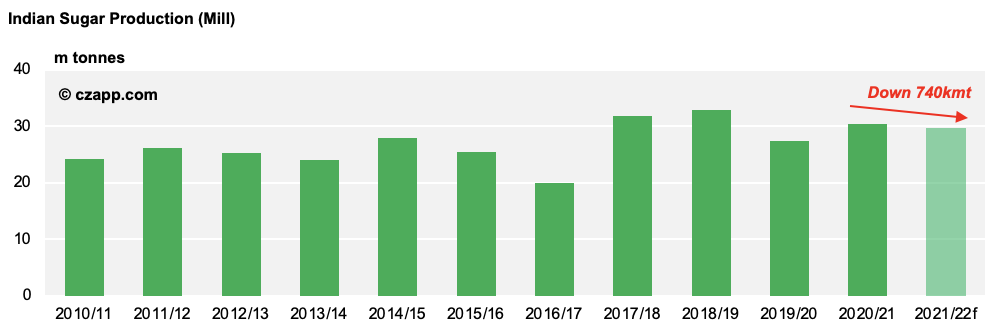

As it stands, we think India will produce 29.8m tonnes of sugar, down 740k tonnes year-on-year. This is because the country will divert more cane towards ethanol production next season.

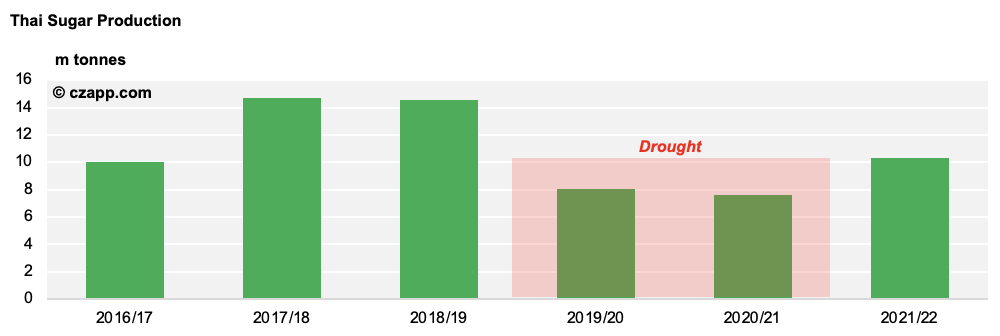

The picture for Thailand is more positive. With record cane returns on the cards, we think it’ll produce 10.31m tonnes of sugar, up 2.74m tonnes from 2020/21, where the country’s cane development was seriously hindered by drought.

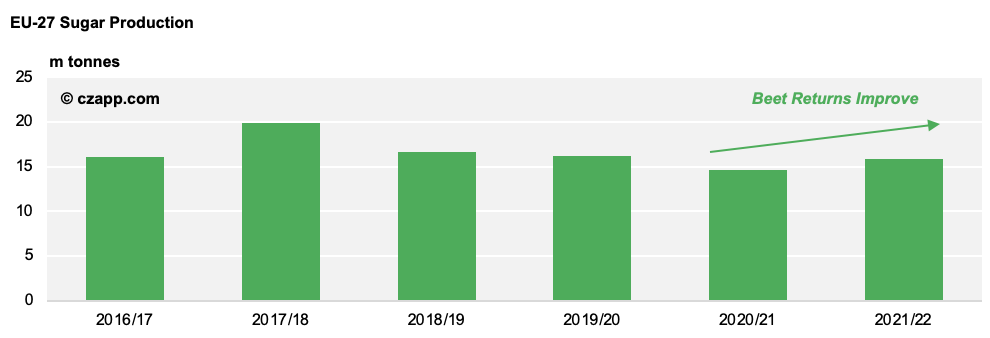

Moving over the EU, sugar production could hit 15.9m tonnes, up 1.3m tonnes from 2020/21’s final figure.

In 2020/21, beet crops across Europe were ravaged by Beet Yellows Virus (BYV), but neonicotinoids, the only known treatment, were banned by Governments across the region. Prices were also poor, which meant plantings were down.

The situation is improving, though. BYV is less rife and beet growers are now being paid more money for their beet, which should see area start to recover in some regions.

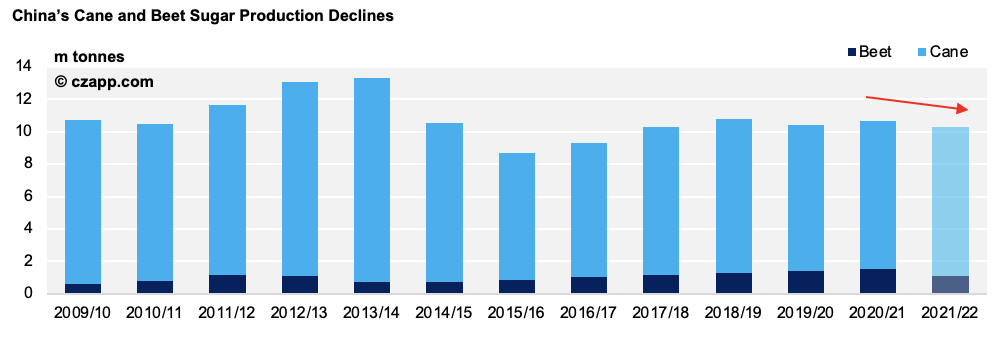

Lastly, in China, many farmers are increasing grains production as the country works to feed its recovering pig herd following the outbreak of African Swine Fever.

The Government has also been promoting rice production ever since COVID hit, with food security a top priority. We therefore think China will produce 10.33m tonnes of sugar in 2021/22, down 340k tonnes year-on-year.

Other Opinions You Might Be Interested In…

- Ask the Analyst: Indian Cane and Sugar Production in 2021/22

- Thai Cane: Fierce Competition from Cassava, Despite Record Prices

- China: Record Sugar Imports Hit Domestic Sales

- Strong EU Beet Production Helps Molasses Supply

Explainers You Might Be Interested In…

- Czapp Explains: The Indian Ethanol Industry

- Czapp Explains: The EU’s Sugar Industry

- Czapp Explains: Thailand’s Raw Sugar Industry

- Czapp Explains: Thailand’s White Sugar Industry

- Czapp Explains: The Sugar Industry in Uttar Pradesh

- Czapp Explains: The Sugar Industry in Maharashtra and Karnataka

- Czapp Explains: The Chinese Sugar Industry