We think that the Government wants to avoid paying sugar export subsidies in 2021/22 season if it can.

The government awarded the 2020/21 subsidy very late in December, by which time cane crushing was well underway. It then removed it in June, well before the end of the season in September. We think this shows that sugar export subsidies are falling out of favour.

The Government has also indicated that sugar export subsidies will not be allowed under WTO rules after 2023 and the subsidies have been challenged at the WTO by Australia, Brazil and Guatemala.

If the Government doesn’t offer a subsidy next season, it’ll rely on the world market reaching and staying at a high enough level for Indian sugar exports to be workable.

However, if sugar market prices fall to a level where Indian mills don’t want to sell for export, the Government may need to offer a subsidy to stop domestic sugar stockpiles from increasing.

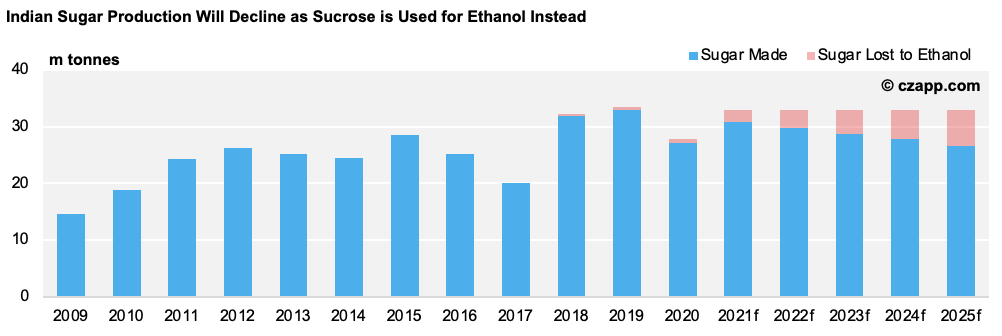

In the longer term, the Government is seeking to develop a local cane ethanol industry to soak up excess sucrose. The Government has incentivised millers to build distilleries capable of processing cane juice or high-sucrose molasses into ethanol for blending with gasoline rather than for sugar production. However, it’ll take time for this ethanol capacity to become operational, which means India will still be overproducing sugar next season by about 4m tonnes.

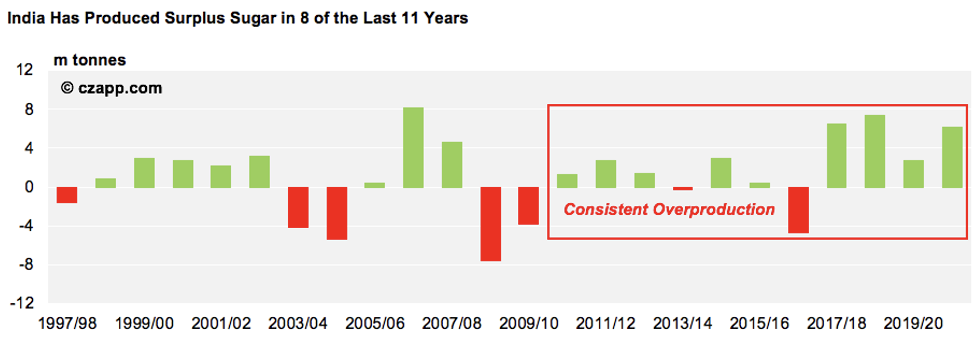

This overproduction of sugar should continue until distillery capacity is sufficient; the Government sets a high cane price to support rural incomes, so planting sugarcane will remain the preferred option for many farmers. This is why there’s been consistent overproduction of sugar in India across the past decade.

Other Opinions You Might Be Interested In…

Explainers You Might Be Interested In…