Opinion Focus

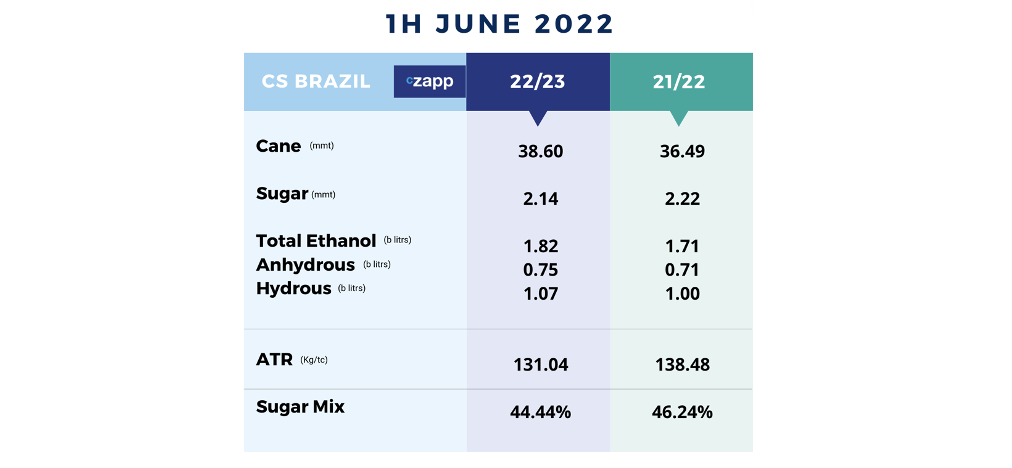

- Lower crush in the first half of June with 38mmt.

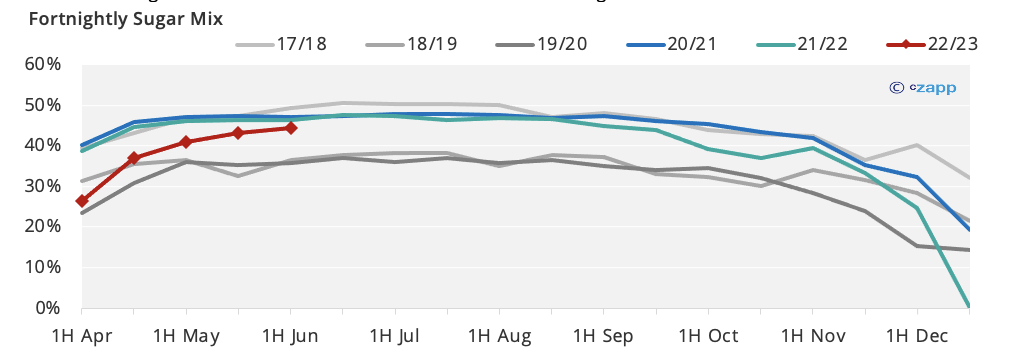

- Sugar mix continues to rise.

- Still, sugar production is behind by 2.2mmt yoy.

1H Jun 2022 Production Figures

Downside Risk

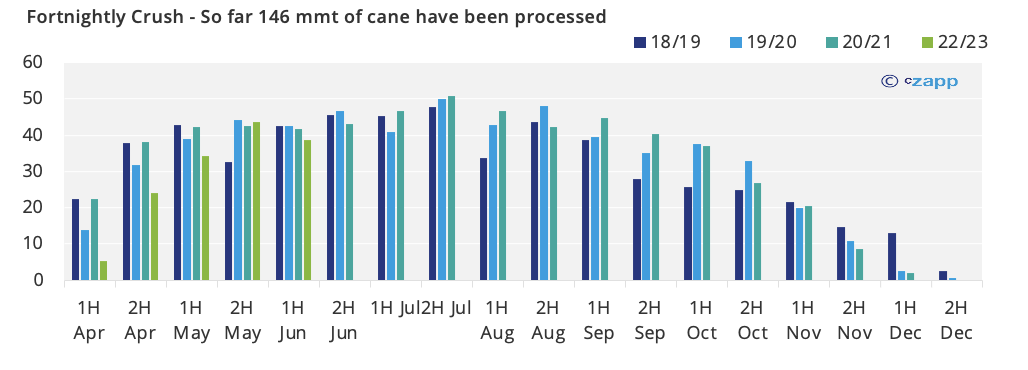

- Even though crush in the 1H of June was higher than last year at 38.6mmt, the cumulative for the season so far is 13% below yoy.

- With more mills starting operations in the upcoming fortnight and increase in the crushing pace, the gap should narrow as the crop progresses.

- However, we believe it might be difficult to make a significant recovery against the previous cycle.

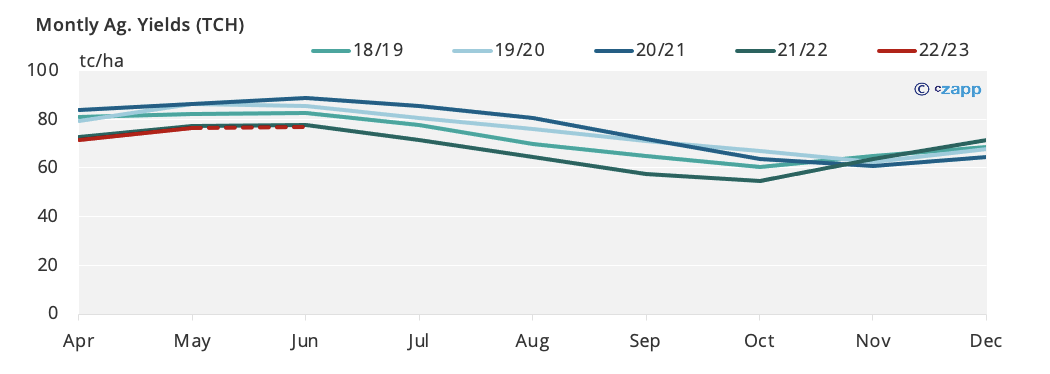

- Agricultural productivity in April and May were lower than 2021/22 – as was expected.

- We believe that from July onwards, agricultural productivity should improve because the sugarcane that will be crushed from next month onwards was benefited with a healthier volume of rainfall throughout its development than the 2021/22 sugarcane – but still was below ideal.

- However, with the beginning of the dry period and risk of frost (winter), recovery is limited.

- The productivity curve, despite being above the previous cycle, should be one of the lowest in the last decade.

- We have reduced our crush projection from 551mmt to 545.5mmt.

Changes on ICMS

- The changes in fuel taxes were approved and implemented last week.

- What it is not clear yet is whether the PEC for ethanol will be approved and guarantee the competitiveness of biofuel.

- Additionally, uncertainties continue to trouble Petrobras with, yet another president replaced and rumours of freezing gasoline prices.

- Even though the harvest started more ethanol oriented, the environment for the biofuel remains uncertain and the sugar mix should continue to rise over the next fortnights.

- So far, CS Brazil has produced 7.2mmt down 24% yoy.

- We remain with our 32mmt sugar production forecast for the season.

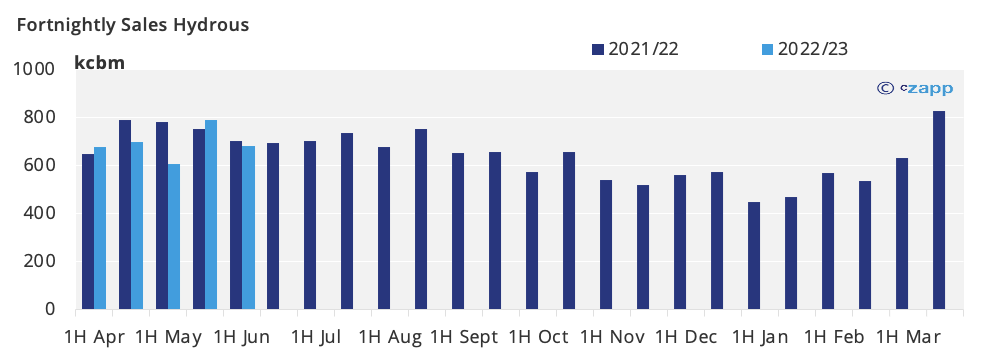

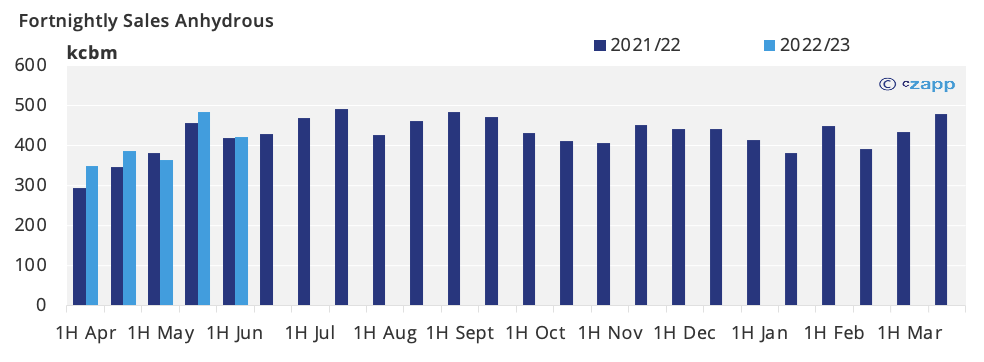

Lower Ethanol Sales

- Regardless of the parity reaching 67% in the first half of June, the fuel has not recovered market share.

- And with the recent changes of fuels ICMS, unless the PEC for ethanol (which must be voted on today) is approved, consumer preference could turn even more to gasoline.

- Anhydrous sales also declined in the past fortnight.

- This behavior seems to reflect a slowing down of the Otto cycle (fuel demand) as a whole.

Other opinions that may be of your interest:

- Taxes Fall, But Gasoline Prices Rise

- What is the Impact of an ICMS readjustment for Ethanol

- Updates Consecana São Paulo – June 9, 2022

- Points of Attention on the Readjustment of Fuel Prices in Brazil

Explainers that may be of your interest: