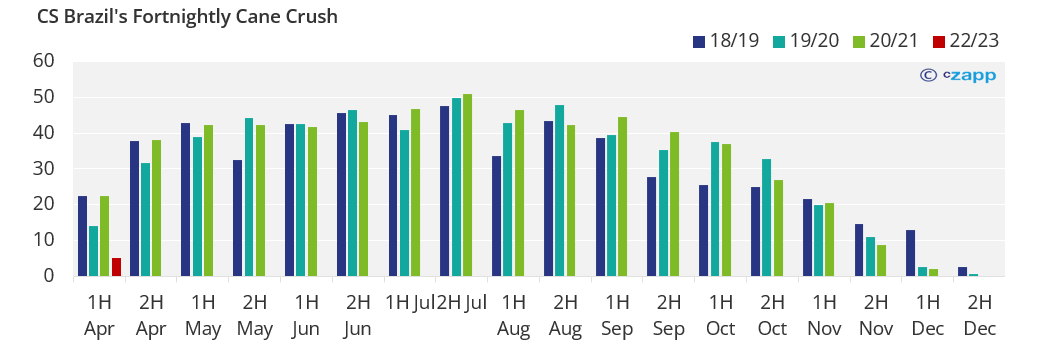

- CS Brazil’s 2022/23 cane crush is underway, but numbers for the last fortnight fell below expectations.

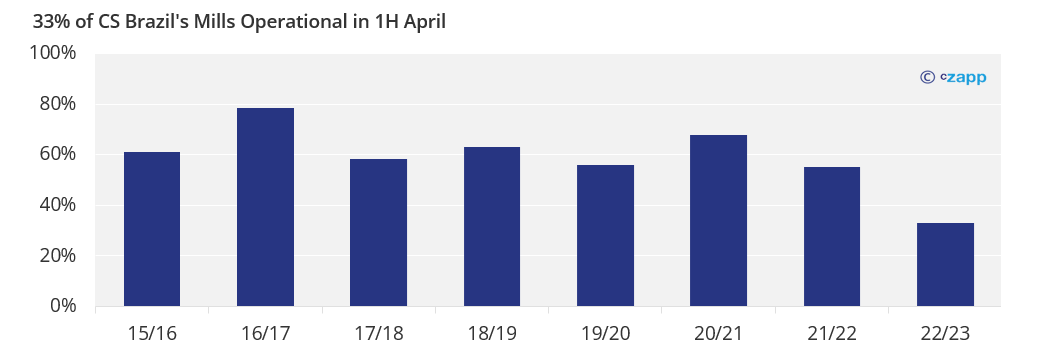

- This is because just 85 mills are currently operational, down 64 on the year.

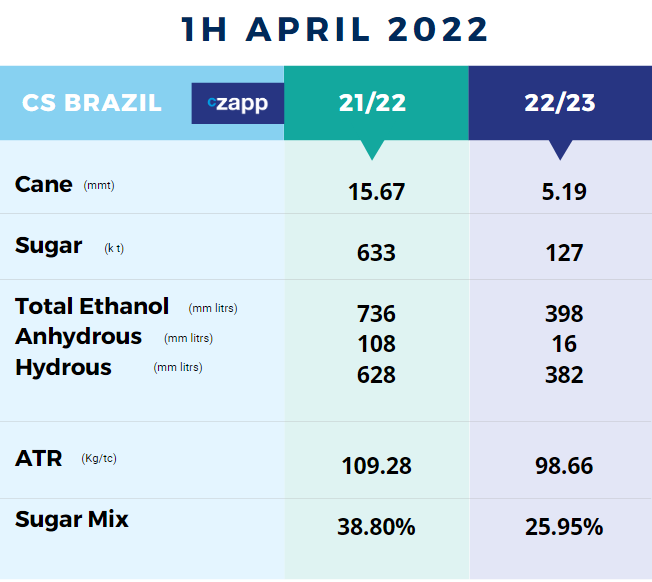

- The mills crushed 5.2m tonnes of cane, with sugar and ethanol production at 127k tonnes and 398m litres respectively.

A Slow Start to the 2022/23 Cane Crush

- CS Brazil’s mills have delayed crushing for as long as possible to give the cane time to develop.

- There are therefore just 85 mills operating in the region at present, down 64 year on year.

- For the next fortnight, UNICA expects a further 104 mills to commence operations.

Source: UNICA

- With fewer mills operational, the country’s crushing progress is down 66% year on year, with just 5.19m tonnes of cane crushed.

Source: UNICA

- The quality of the raw material was also affected, with the ATR reaching 98.66 kg/tonne, down 9.72% on the year.

- In general, the quality of the raw material is inferior at the beginning of the harvest, especially in the current case with the rains close to the historical average.

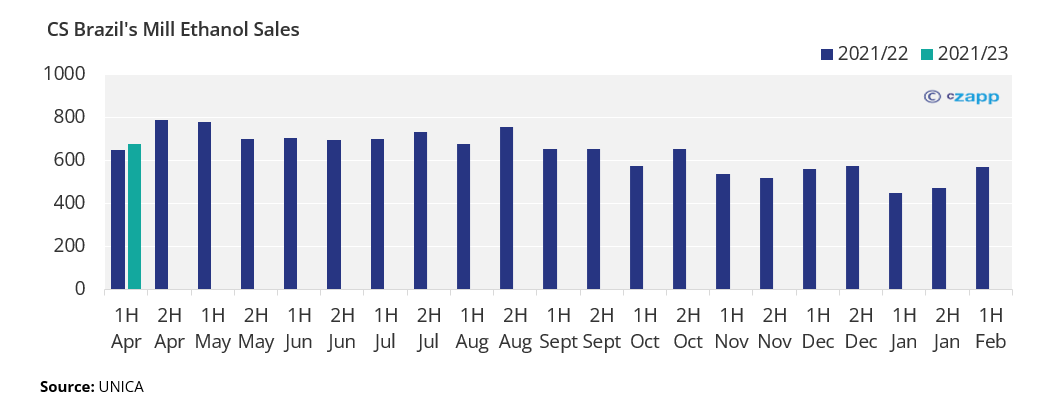

Heated Ethanol Sales

- Ethanol sales grew in the first fortnight of the crop, with 1.03b liters sold, up 6% on the year.

- This happened because ethanol prices were favorable for drivers, with pump parity below 70%.

- Across the next fortnight, ethanol sales should decrease with today’s pump parity above 76%.

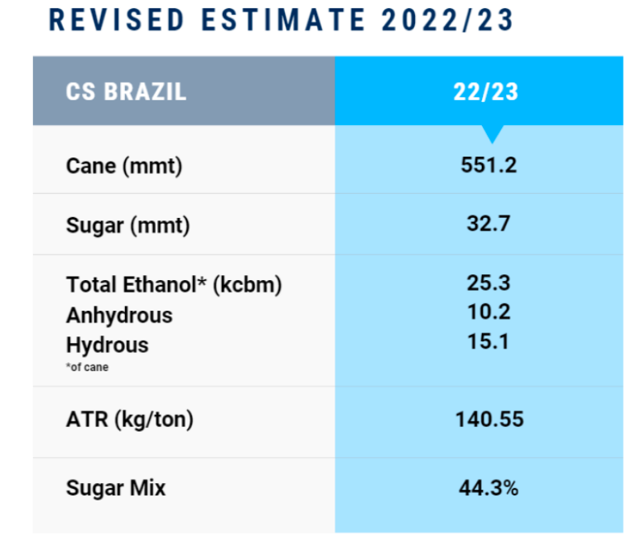

Cane Crop Estimates for 2022/23

Click here to read the report on our 2022/23 crop estimates.

Other Insights That May Be of Interest…

Explainers That May Be of Interest…