- Thailand has delayed its E20 fuel blend target for another year.

- Its cane and cassava production are currently too low to hit the target.

- It’s also not yet able to manufacture enough E20-friendly vehicles for the fuel type to be adopted on a wide scale.

Thailand’s E20 Fuel Blend Target

- In 2018, the Thai Government developed its ‘Alternative Energy Development Plan (2018-37)’, often referred to as ‘AEDP 2018’.

- Through this, it hopes renewable energy will account for 30% of Thailand’s total energy consumption by 2037.

- To help make this happen, Thailand has vowed to increase the amount of ethanol its blends with gasoline.

- It currently has a 10% blend rate (90% gasoline, 10% ethanol) and wanted to increase this to 20% in July this year.

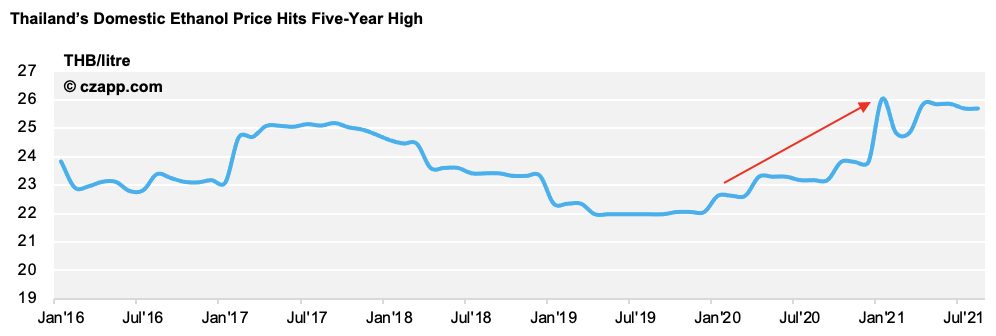

- However, this was postponed to next year as ethanol prices soared to a five-year high on the back of higher feedstock prices (notably cassava and molasses).

- At this level, it’s tough for the Government to incentive the switch over to E20 fuels.

How Achievable is the Government’s E20 Goal?

- The Government has a lot of work to do if it wants to hit its E20 target.

- It first wants to increase the amount of cane and cassava it produces, as both crops can be used to produce ethanol.

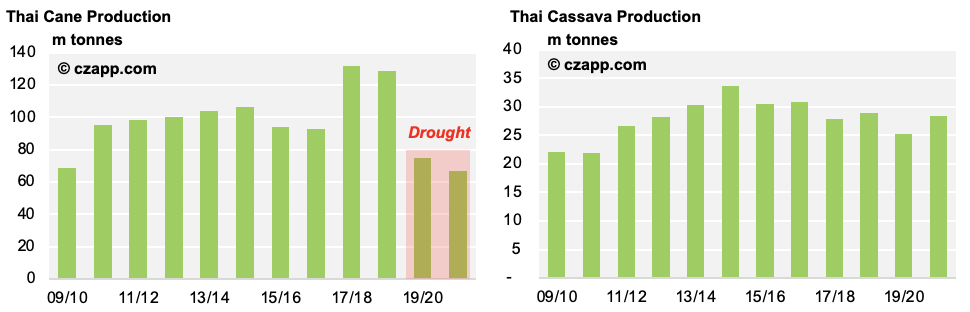

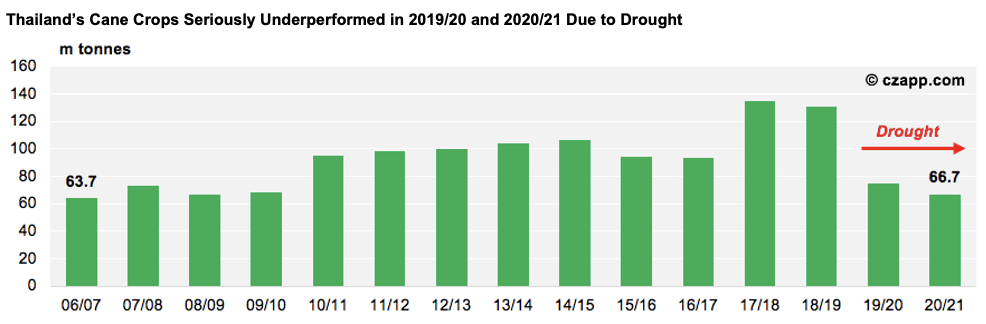

- As it stands, Thailand produces around 99.7m tonnes of cane per year, and 29.1m tonnes of cassava.

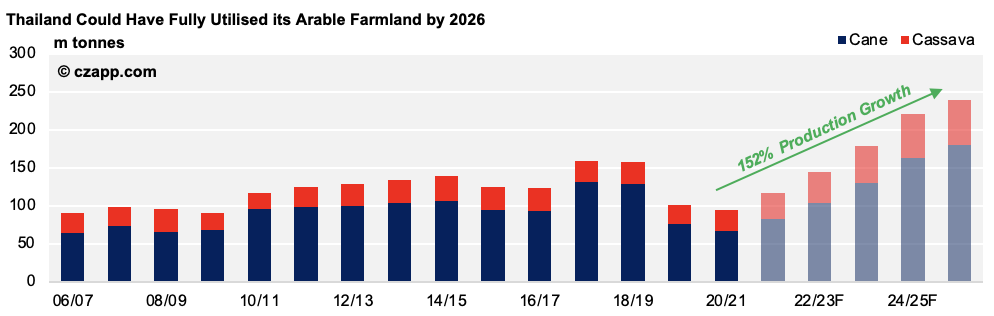

- However, it needs to be producing at least 182m tonnes of cane and 59.5m tonnes of cassava to hit its E20 target.

- To increase its production of both, the Government hopes to enhance the performance of Thailand’s agricultural machinery and invest more heavily in the technology that’s used to make ethanol.

- This is because there’s little room for Thailand to expand cane and cassava area, so it must instead focus on increasing agricultural yields.

- Thailand’s currently dabbling with urban and vertical farming, but cane and cassava are not the most compatible here as they are “cash crops”, meaning they can’t yet be vertically grown on a large enough scale to turn a profit.

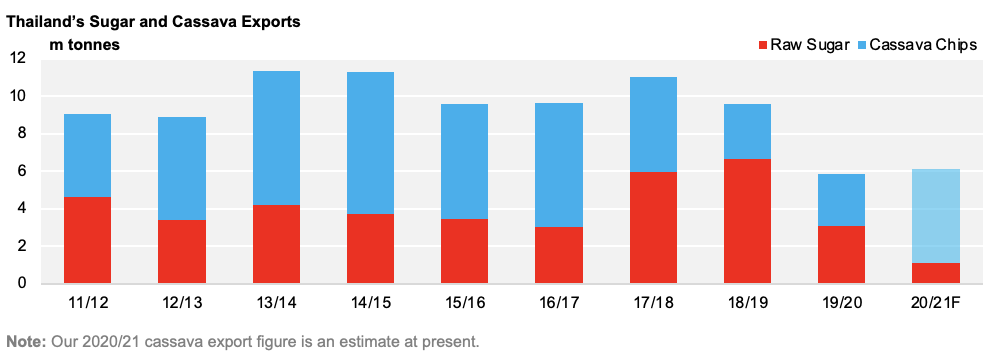

- This is interesting because, in theory, the Government could instead reduce the amount of sugar and cassava products it exports, either by increasing the ethanol price or taxing exports.

- As it stands, Thailand exports around 4m tonnes of raw sugar each year, along with 5.3m tonnes of cassava chips.

- Beyond this, Thailand must also increase its ethanol production capacity.

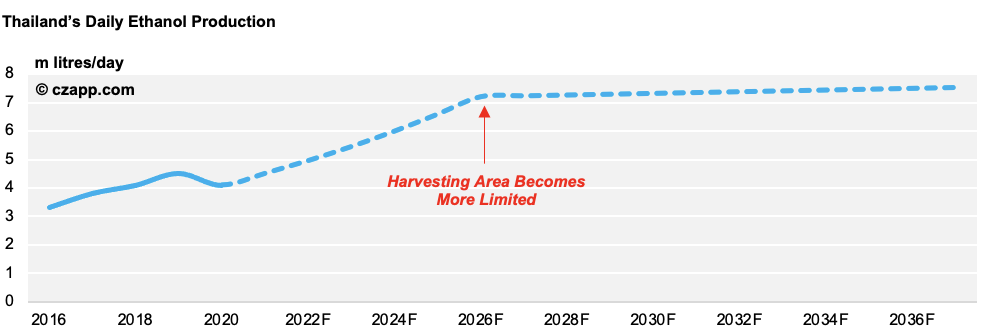

- Thailand has just 27 mills with the capacity to produce ethanol at present, which collectively make 6.3m litres of ethanol a day.

- To successfully roll out E20 fuel across the country, they must produce 7.2m litres a day in 2026 and 7.5m litres a day in 2037.

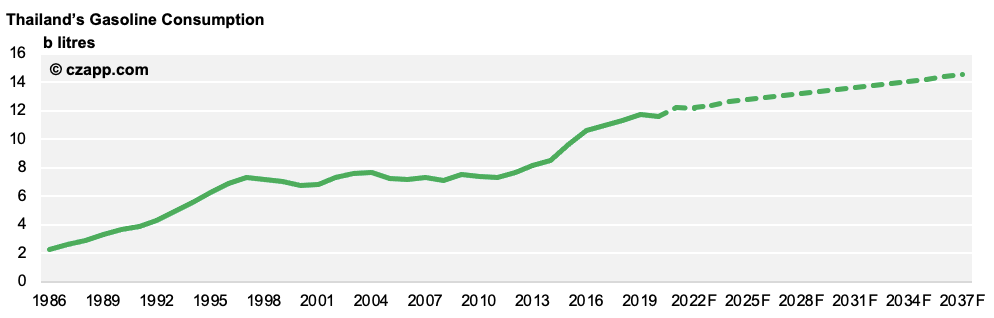

- This is because Thailand could be consuming 14.5b litres of gasoline a year by 2037, up from 2.2b litres today.

- It therefore needs a lot more of the two major feedstocks (molasses and cassava), and more mills capable of producing ethanol.

- Other potential feedstocks, such as barley, sorghum and potato do exist in Thailand, but aren’t grown on a large enough scale to make be widely used at this point.

- The mills are also unable to freely change the feedstocks used in their production processes.

The Work Doesn’t Stop If and When Thailand Hits its Target

- If Thailand does hit its target, there are still obstacles to overcome.

- It’ll need to increase the number of gas stations that can supply E20 across the country; 60% of Thailand’s gas stations currently supply E20 fuel.

- It must then convince the people of Thailand to use the E20 blend.

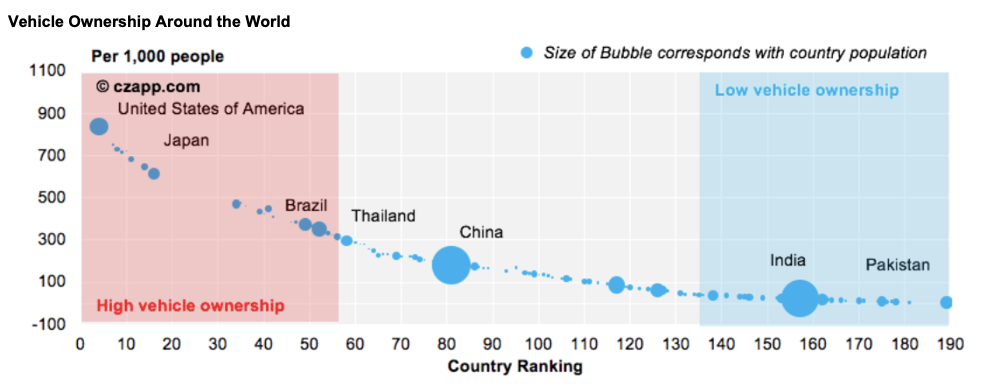

- At the end of 2020, Thailand had 41.5m vehicles registered on the road; it’s likely most of these vehicles were running on E10.

- So, using E20 fuel on a wide scale means vehicle technologies must be developed so they’re compatible with higher concentrations of ethanol; generally, cars that were manufactured in or before 1986 are incompatible with E10 fuels.

- These developments will cost money, for both the Government and drivers in Thailand, especially if they have to buy new vehicles.

- It’ll therefore need to develop and promote tax and financial incentives.

Our Concluding Thoughts on Thailand’s E20 Target

- We think it’s unlikely Thailand will be able to increase its cane and cassava production by 152% growth by 2026.

- This is purely because, in the recent past, we’ve seen Thailand suffer enormous crop losses due to flooding and drought, both of which are unpredictable and difficult to manage.

- We therefore think the Government needs to establish a more clear-cut path towards E20 fuel use across Thailand.

Other Opinions You Might Be Interested In…

Explainers You Might Be Interested In…