Opinion Focus

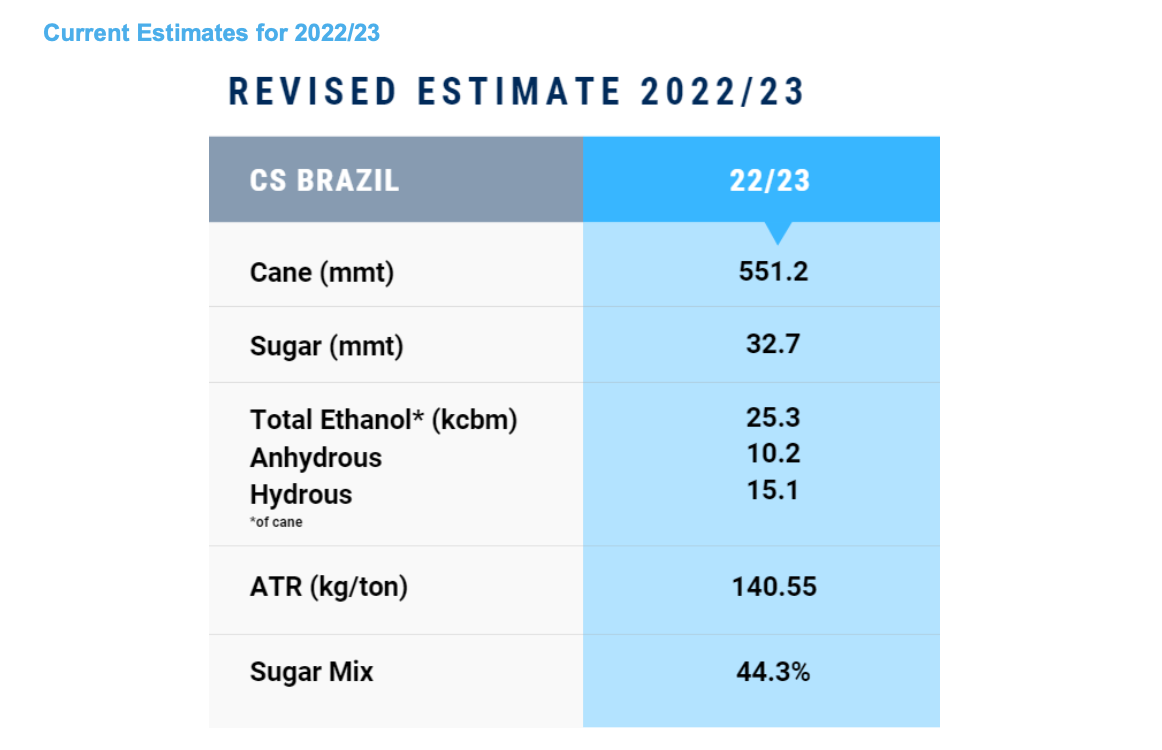

- We have increased our cane crush estimate of 22/23 by 11mt to 551mmt.

- With this, we believe that 32.7 mmt of sugar and 25.3 billion liters of ethanol will be produced

- But unlike past seasons, we cannot affirm we will see a max sugar crop since the key word this year is flexibility.

Current Estimates for 2022/23

Increased Yields

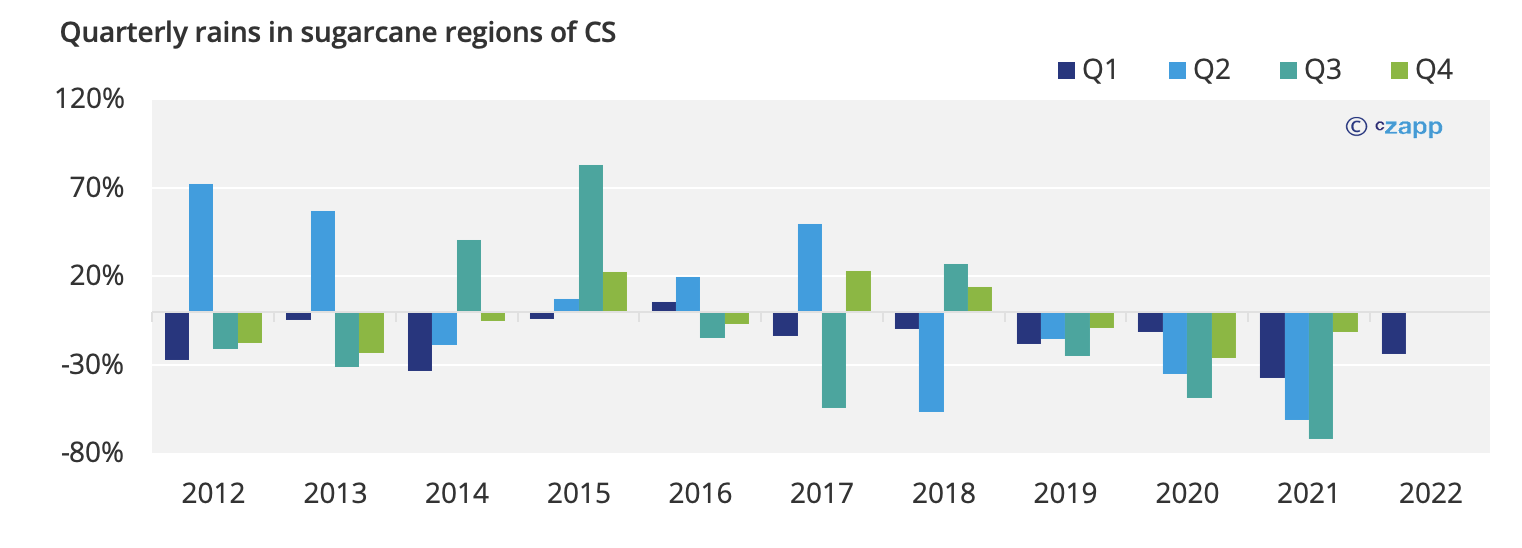

- Rains in Q1, which are essential for the development of the sugarcane, were 20% below historical average in Center South.

- At first glance, it doesn’t seem like a very promising volume, but it is much better than the volume recorded of 40% lower over the same period in 2021.

- The rainfall, although lower than average, is followed by good rains in Q4 of last year, which brings relief to the cane fields and should have a positive impact on agricultural productivity (TCH).

To monitor rainfall forecasts on a weekly basis, access our Interactive Weather Report.

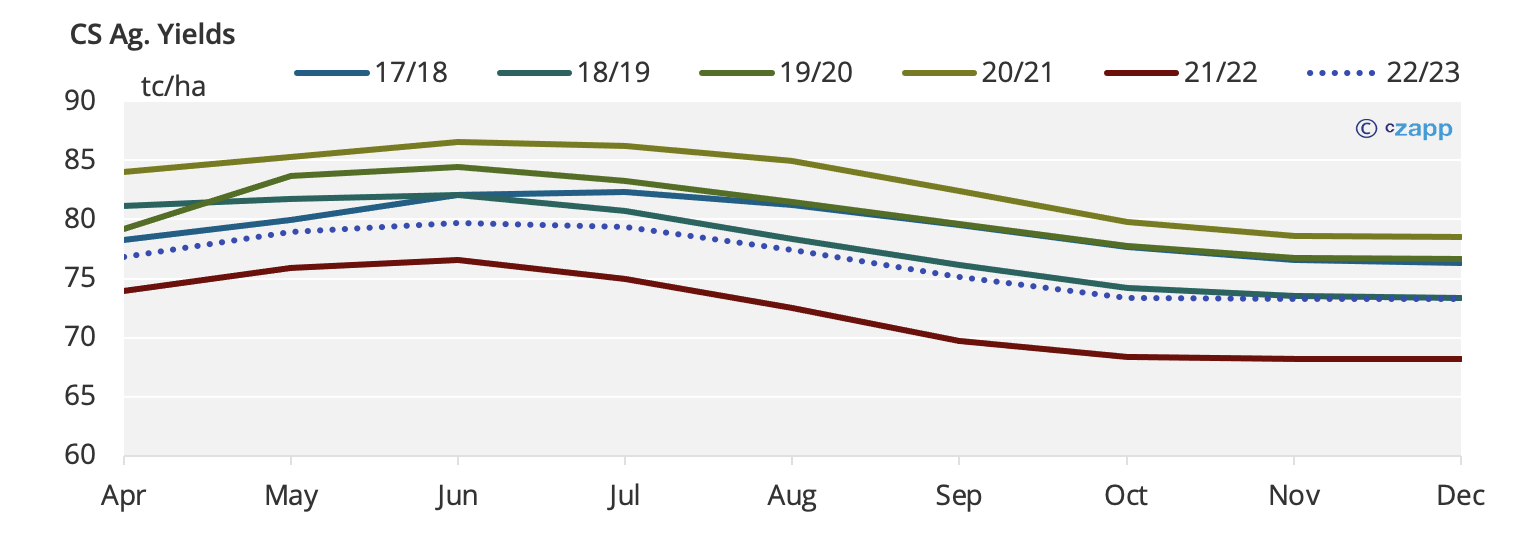

- However, we do not believe that the TCH could improve much further

- Other factors also determine the development of sugarcane, such as age and crop maintenance.

- The canefileds are older, as last year’s dry weather prevented the mills from carrying their renovation plans.

- Older cane field are more susceptible to adverse weather.

- Our estimate at the moment points to a recovery of over 7% in TCH for this crop, going to 73.23 tc/ha.

- As a result, we increased our estimated cane crushing by 11mmt to 551mmt for the 2022/23 crop.

Max Sugar or Max Ethanol?

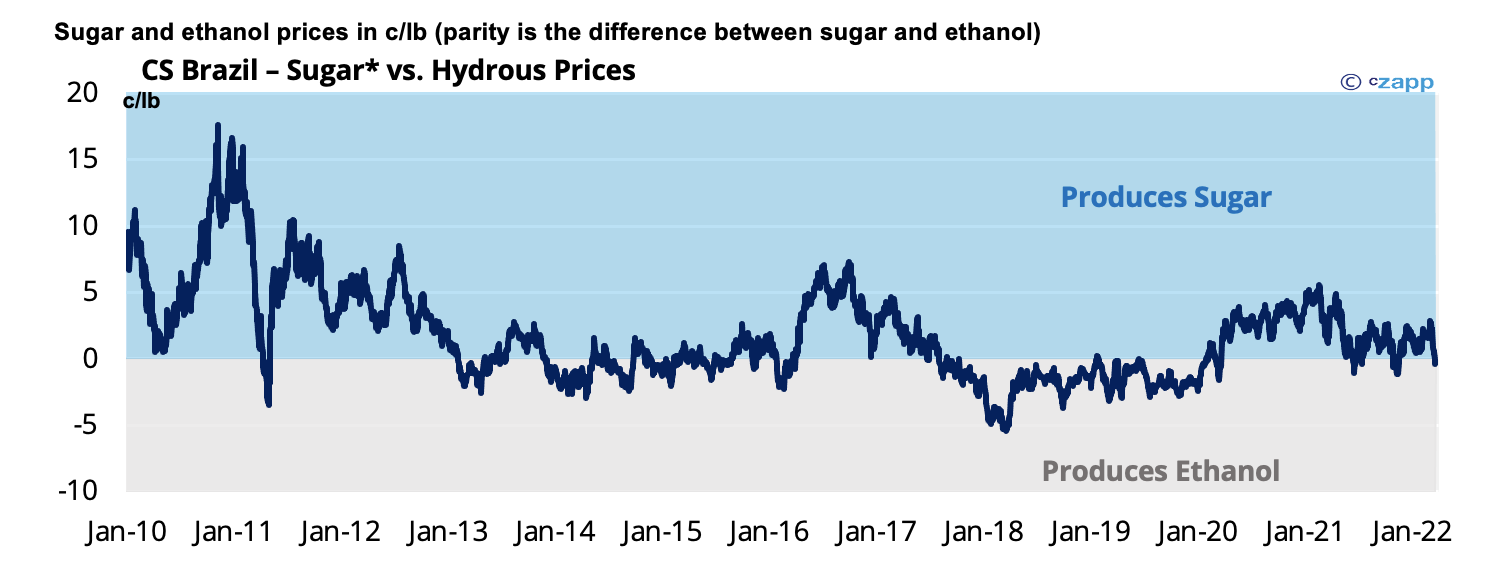

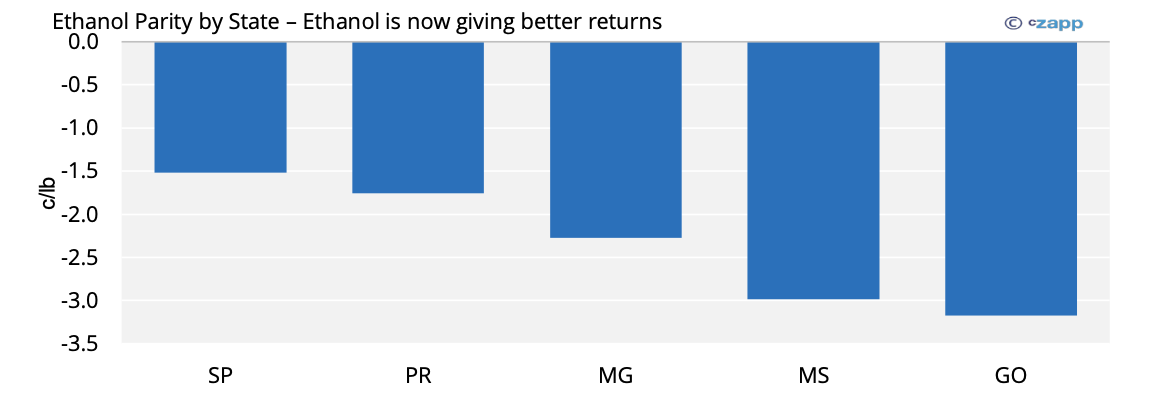

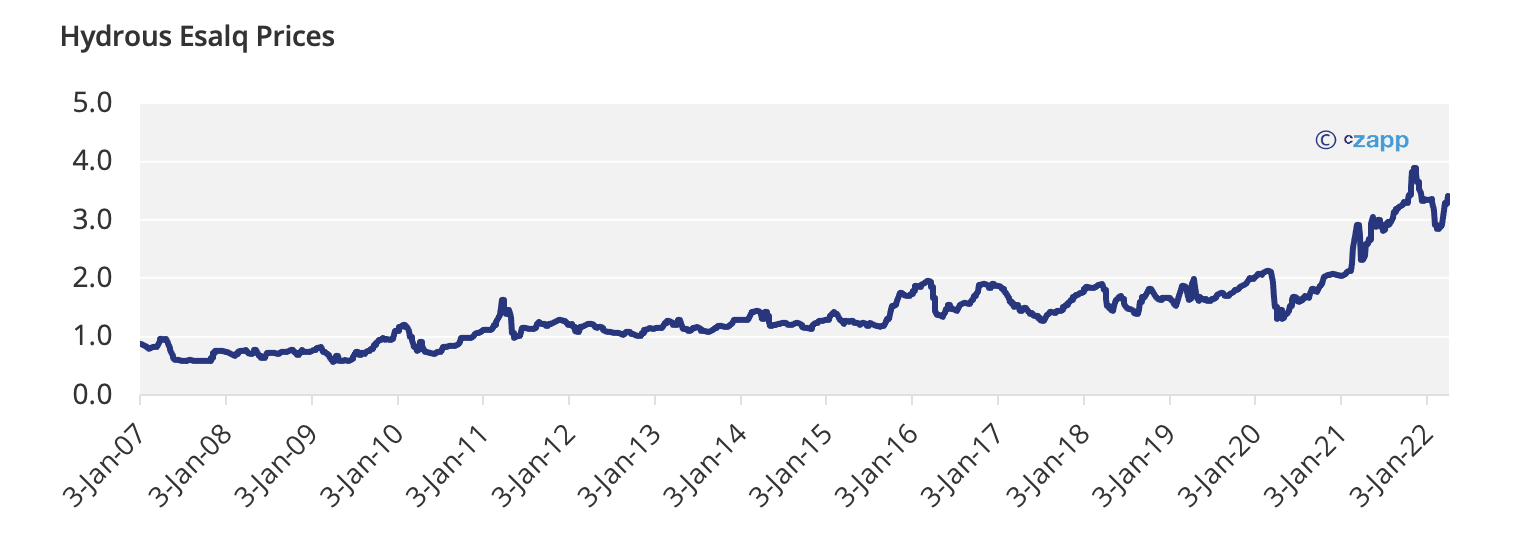

- After two crops with the parity favouring sugar, the sweetener seems to be losing ground to ethanol.

- With ethanol prices on the rise and a stronger BRL, the biofuel is now about 200 points above sugar.

- As ethanol offers greater liquidity (since it is usually paid D+1), it is even more attractive for mills to rethink their production mix.

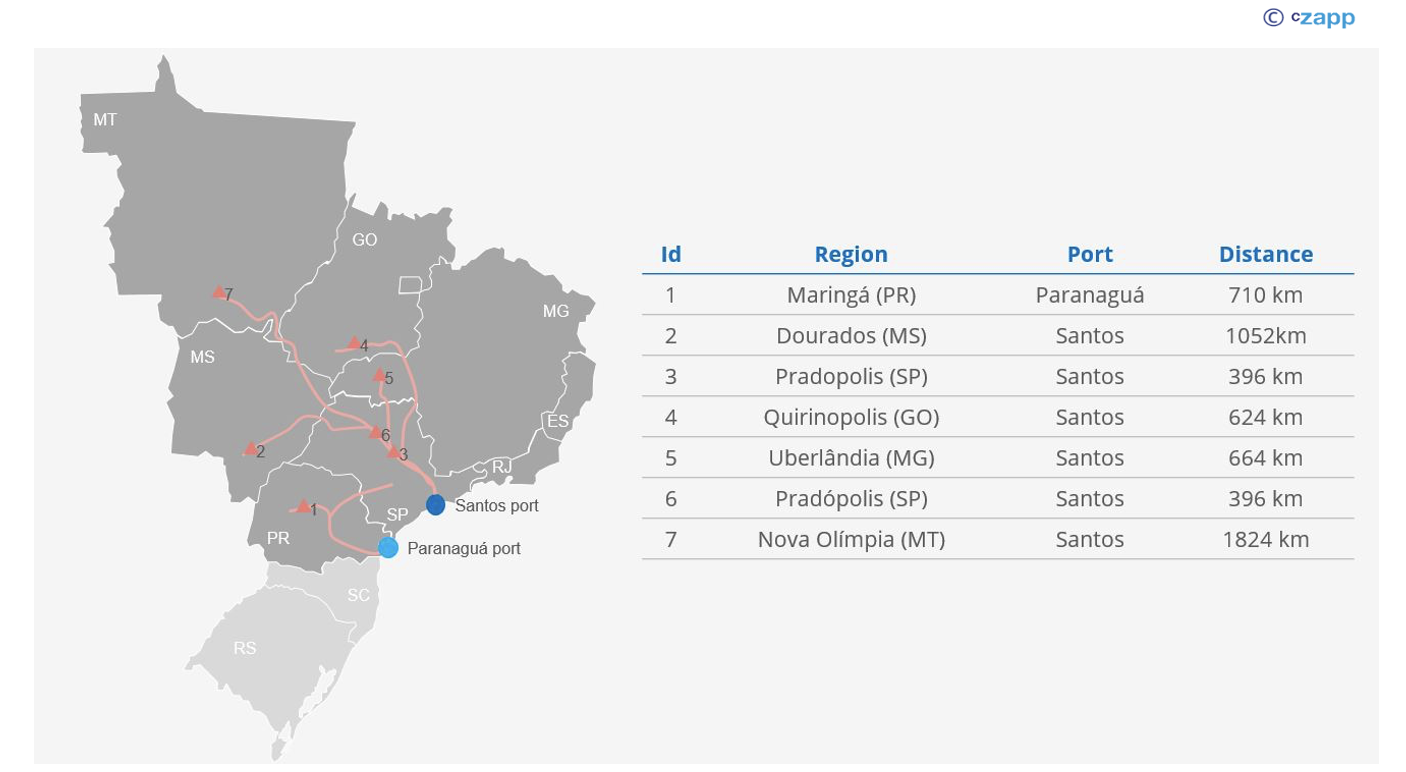

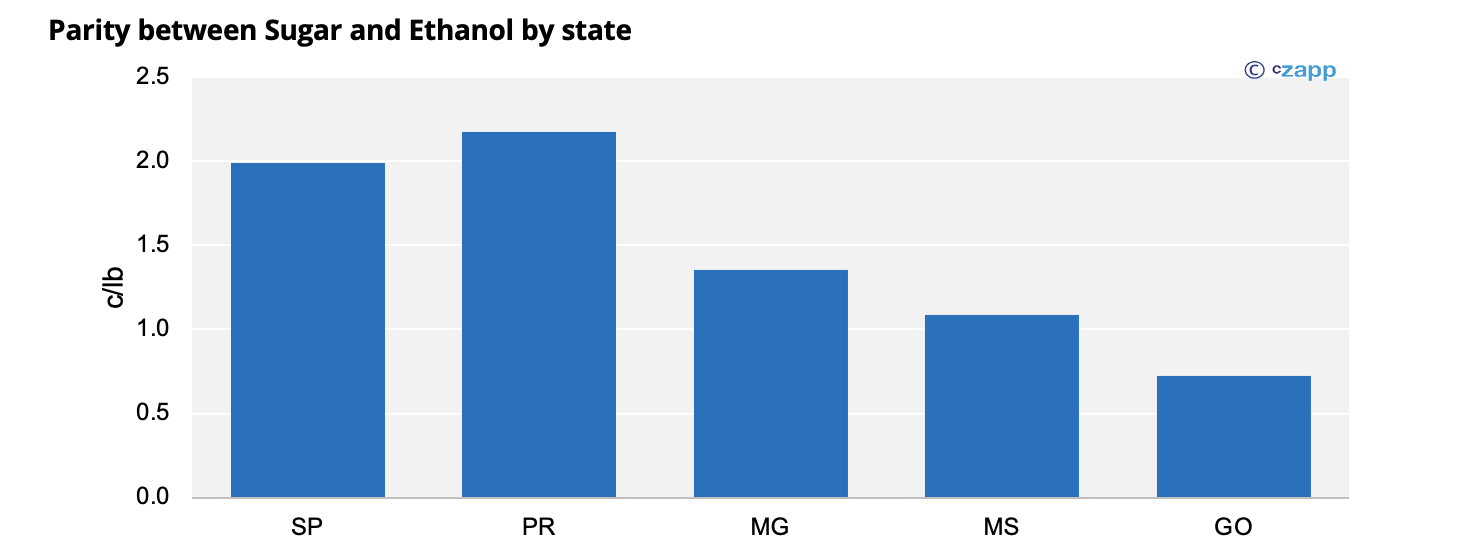

- When we analysed by state, in some regions ethanol today offers almost 300 points above sugar due to the freight differential.

- But this is today, and the crop has barely begun.

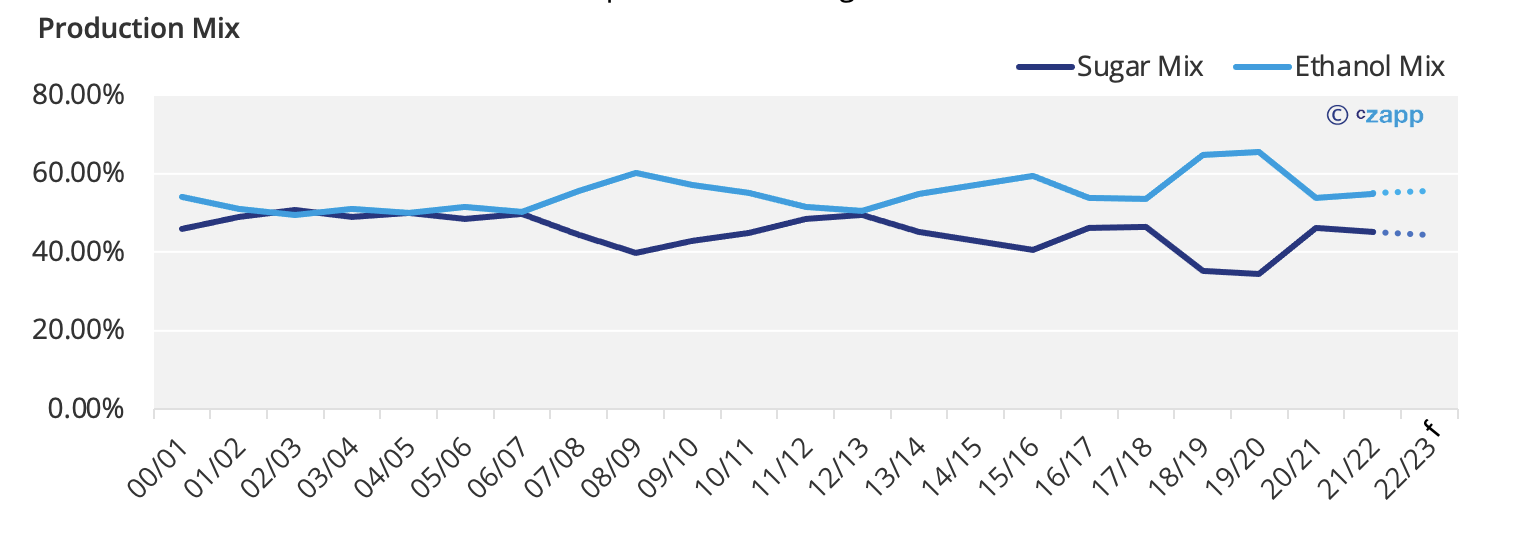

- Although the graph above is frightening and leads to think of a max ethanol crop, the environment is not the same as in the 2018 and 2019 crops. – When the sugar mix was around 35%.

- Unlike those years, it is important to remember that currently more than 70% of the sugar is hedged and the volume is compromised.

- In addition, many mills have volumes that rolled from the past crop and are committed to delivering this sugar.

- As a result, many units that would start the season producing more ethanol are forced to produce sugar at the beginning of the crop to meet their contracts.

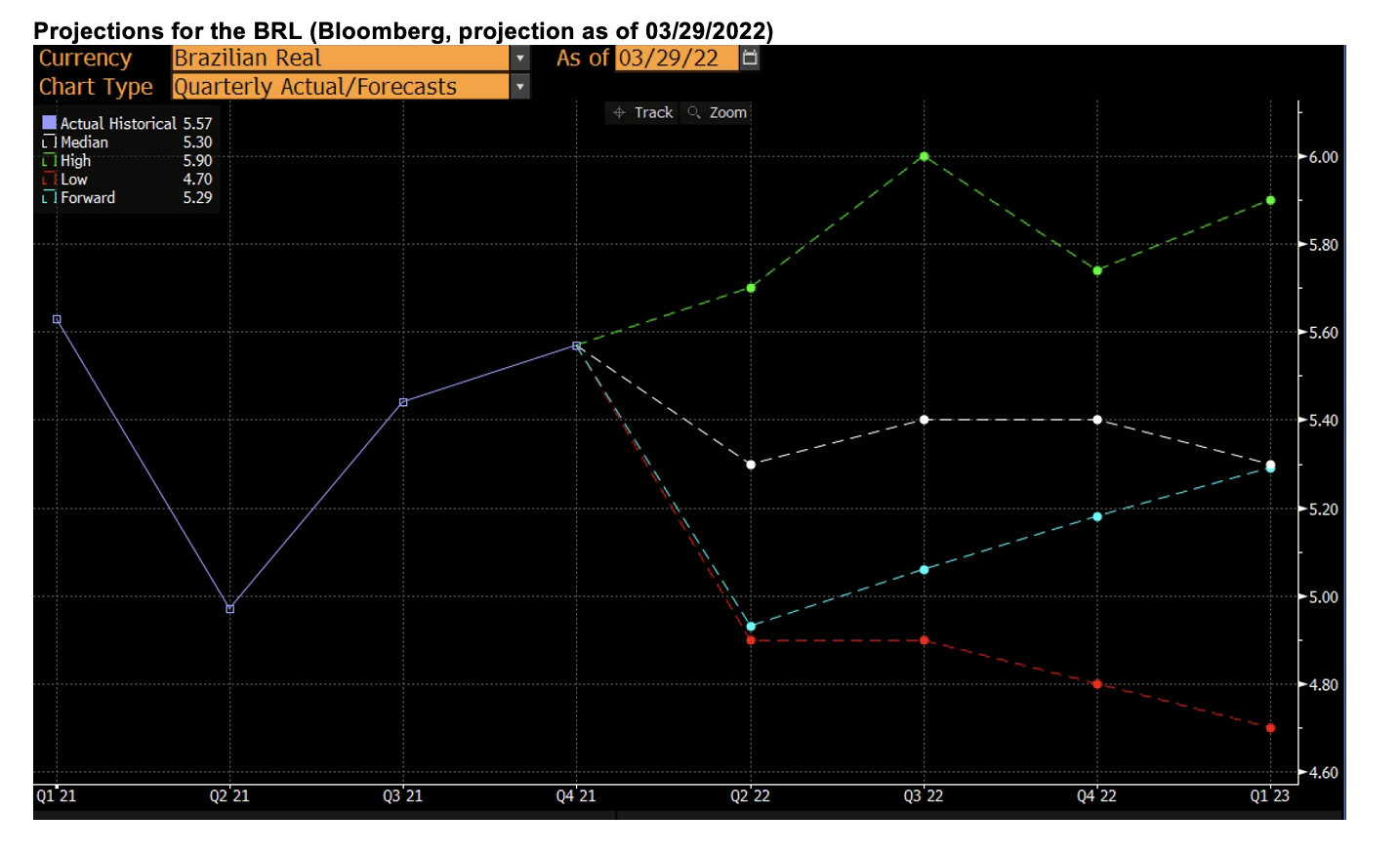

- Another factor is the expectation of a higher return for sugar in BRL/ton, given the probability of Brazilian currency weaking again with the proximity of the presidential elections in October.

- In addition, unlike sugar, which is normally hedged, in ethanol the futures contracts are less used and when used a discount is applied – that is, the future curve in the Sao Paulo stock exchange (BMF) is not necessarily what they are able to capture.

- Would millers be willing to remain exposed to the risks of ethanol?

- Not just price volatility, but this year’s political uncertainty?

Increased Political Risk

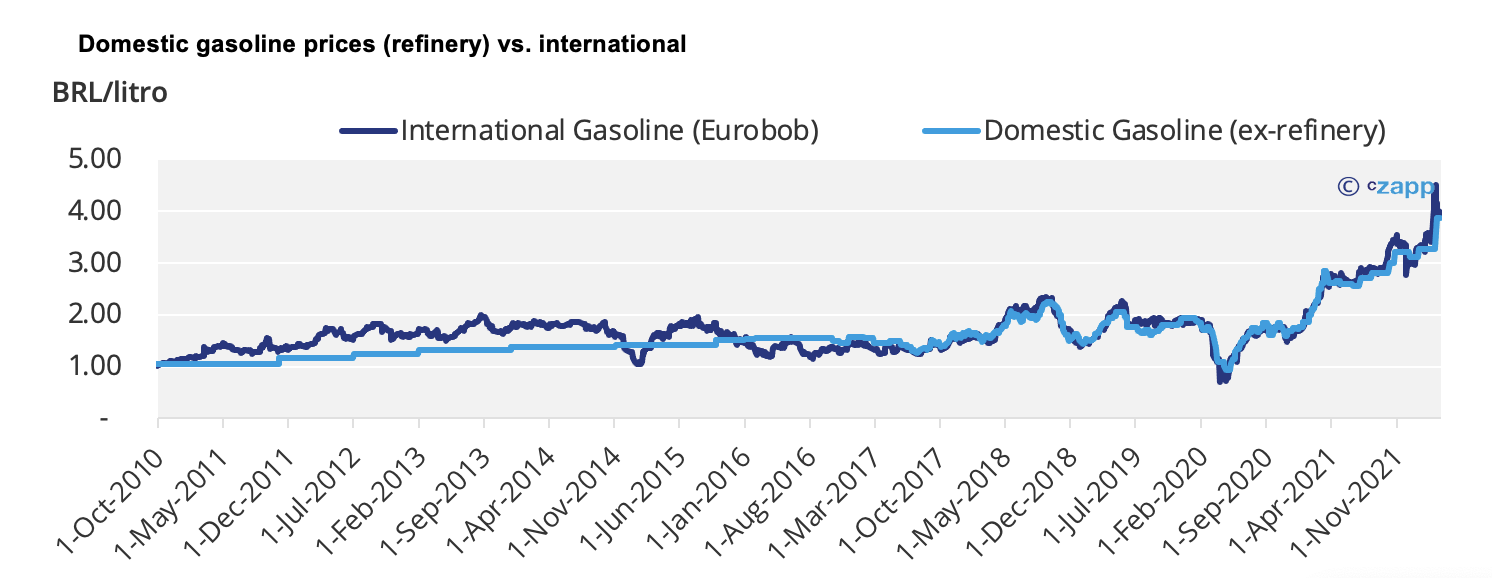

- Following the rise in Brent oil, the gasoline prices in Brazil are getting more and more expensive:

- Prices at the refinery are now at R$3.86/liter, a record level – giving drivers an average of R$6.86/liter in the state of São Paulo.

- And high fuel prices in an election year are not particularly popular.

- When facing this reality, the government is trying to think of several alternatives to prevent the rise from continuing:

- At Petrobras, the president was fired last week less than a month after the 18% increase in gasoline – this could be a sign of intervention or just a signal to the population that “something is being done”.

- The new president-nominee has not accepted the position and remains unclear who will be up for the job.

- The instability within Petrobras raises even more uncertainties about the fuel price policy.

- Another attempt to reduce the price at the pump was the decision to eliminate the tariff on ethanol imports, as gasoline contains 27% anhydrous ethanol in its composition.

- The Senate has approved the Gasoline Price Stabilization Account (CEP) – the policy establishes a price band within which gasoline can vary – a maximum and a minimum price limit will be fixed.

- However, the values have not been defined so it is not yet known how much this can effectively influence prices.

- So far, none of these actions have affected gasoline prices at gas stations, but depending on how this unfolds we will see a limit on the rise in gasoline prices, which in turn limits the rise in ethanol prices.

- Last week, the weekly Esalq hydrous ethanol index strengthened 4.26% to 3.4135 BRL/litre

- However, this is today and the situation should change once the crop starts and fresh supply enters the market. -we are already seeing ethanol price indication 20 cents per litre cheaper than last week.

- Although at the moment ethanol is attractive to producers, its future remains uncertain and risky.

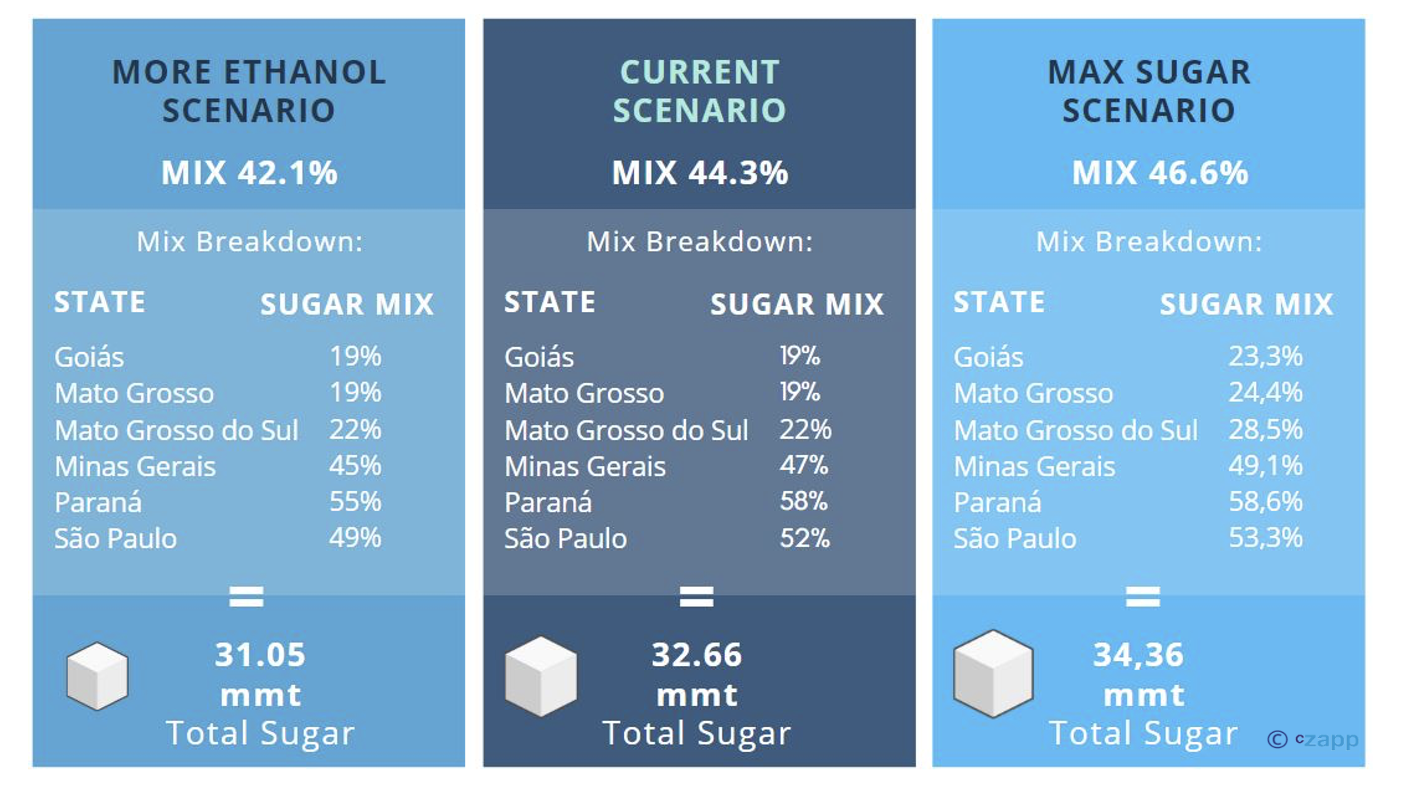

- That said, we are estimating a sugar mix of 44.3%.

- A slightly less sugary mix than the 2021/22 crop which ended at 45%.

- But far from a max ethanol mix like the ones registered back in 2018/19 and 2019/20.

Frontier States Will Decide the Mix

- In the past 2 crops, the sugar prices were so attractive that even the frontier states increased their mix to sugar.

- Generally, due to the distance to the ports, higher freight rates makes sugar less attractive.

- But given the behaviour of the sugar and ethanol price parity, we cannot say that a max sugar scenario is given.

- As said in the previous session, in some states the parity today favours ethanol by more than 300pts.

- If we see these values holding up in the upcoming months, we think that some mills may review their strategy for the season.

- Would that mean max ethanol, with the sugar mix dropping down to 35%? We believe not.

- However, if ethanol prices remain more attractive, our model points out that the mix could drop to 42% – reducing 1.6mmt of sugar from the world balance.

- On the other hand, if the ethanol prices declines and the exchange rate weakens (as the presidential elections approaches), we can see that the parities of all states once again favour sugar production.

- In this scenario we use a currency at 5 BRL/USD and ethanol prices at 2.80 BRL/l which would indicate the lowest value for ethanol price at the peak of the crop.

- Therefore, for now, we believe that an upside for sugar has a higher probability than the other way around.

Concluding Thoughts

- The 2022/23 crop is still pro sugar, although a little less than the previous two seasons.

- We see mills opting for greater flexibility in order to be able to respond for the best value product.

- If ethanol remains attractive, either due to a strong BRL, fall in No.11 prices or even higher gasoline prices, the mix could start to fall.

- While we believe there is more downside risk for ethanol prices than upside, parity should be analysed close and by region over the course of this season.

- Don’t settle down just yet, the crop is not defined…

Option that you might like

· How the Brazilian Fuel Price Adjustment Hits Sugar and Ethanol

· What Would a Brazilian Fuel Price Hike Mean for Sugar?

Explainer that you might like

· Czapp Explains: The Brazilian Ethanol Industry