- Mills in operation are close to the number seen last year, but crushing volume remains slow.

- Lower-than-expected agricultural productivity reduces likelihood of upside in the cane crush.

- Sugar mix remains low and cumulative sugar production is 33% lower than the previous year

1H May 2022

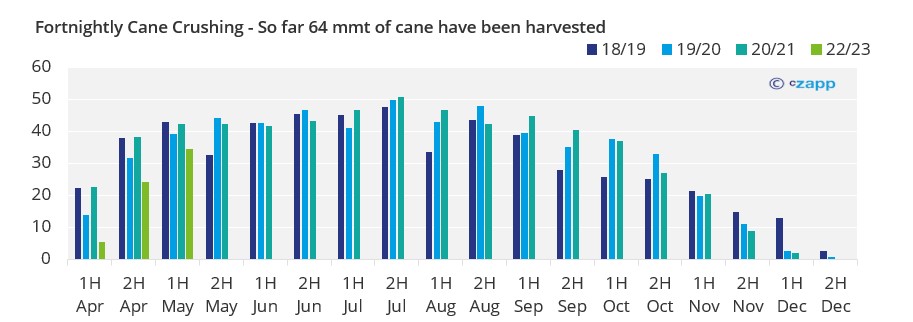

Crushing is below expectations

- The amount of cane harvested reached 34.4 mmt, a significant improvement compared to the previous fortnights.

- But it continues to lag in relation to the same period last year – a retraction of 17%.

- The improvement in the crushing rate is a consequence of more mills starting operation in the fortnight, totaling 232 units – just 4 less than last year.

- By the end of the month, another 17 units should start the crop.

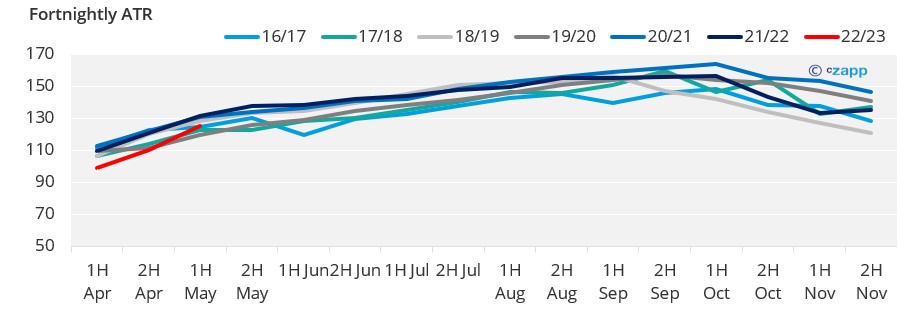

- The slower pace of the beginning of the harvest is also related to the lower quality of the raw material at the start of the crop (in red in the graph).

- In this fortnight, the mill’s ATR improved significantly, rising from 110.35 kg/tc to 124.95 kg/tc – but still at lower levels than the last two crops.

- It is important to mention that the preliminary agricultural productivity data for April indicate a TCH similar to last year – 73t/ha.

- Although we were already expecting a beginning of the crop with a more damaged sugarcane affected by the 2021 drought, TCH at this level was below our estimates.

- If sugarcane productivity fails to recover in subsequent months, there is a risk of a reduction in the expected crushing cane volume in Center South.

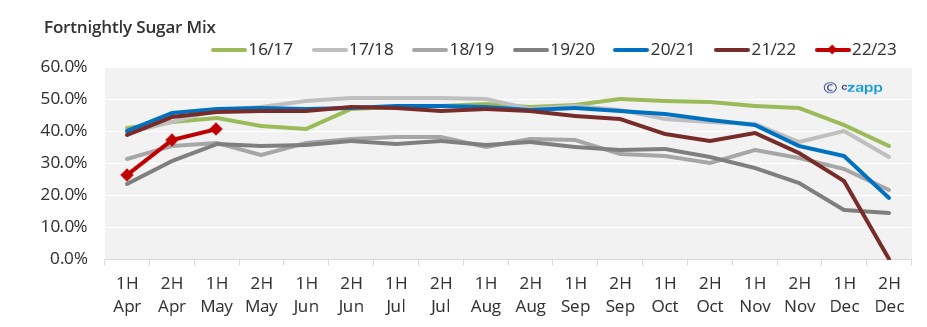

A More Ethanol Oriented Start

- Sugar production until 1Q May was 1.66 mmt – volume 33% lower than last year.

- Part of this is related to the weaker cursh, but more importantly, it’s the result of the production mix.

- Most mills started the crop by allocating more cane to ethanol production.

- This is due to ethanol returns are around 100 points above sugar, average for a mill in São Paulo.

- With the price of ethanol falling as the crop progresses, the expectation is that production will begin to be increasingly allocated to sugar.

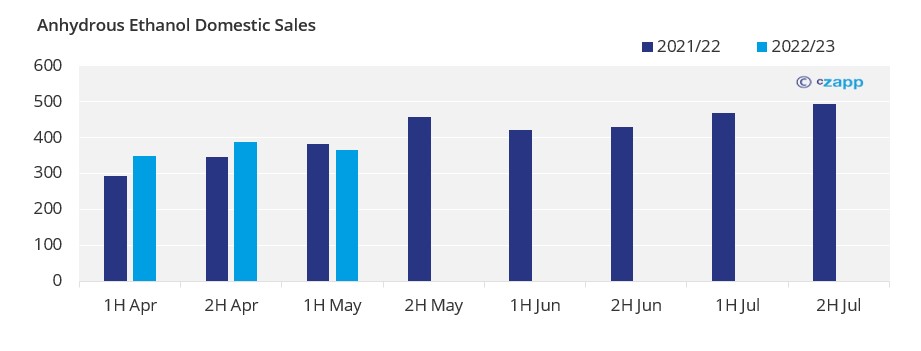

Drop in Hydrous and Anhydrous Sales

- Unlike the last fortnights, there was a retraction in domestic sales of anhydrous at the beginning of May.

- A total of 363.92 million liters were sold in the fortnight – a decline of almost 5%.

- The drop in sales in the domestic market may reflect the volume of more than 120m liters currently in the ethanol lineup – all entering the Northeast of Brazil (NNE).

- This reduces the need for ethanol transfers to the NNE region, and consequently should impact anhydrous sales by the Center-South mills.

Explainers that you might like: