Opinion Focus

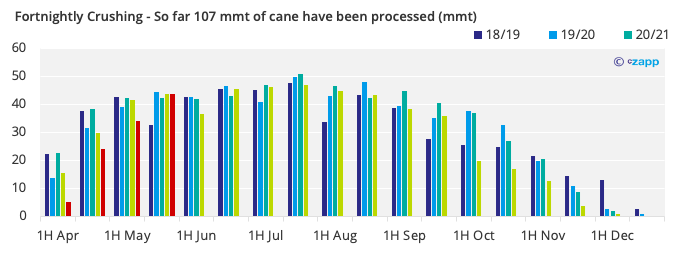

- Crushing advanced on the H2 May with 44mt of cane processed – in line with the previous crop

- Even so, the cumulative volume of sugarcane remains 18% lower than 2021/22.

- Sugar mix strengthened closing the fortnight at 43.16%

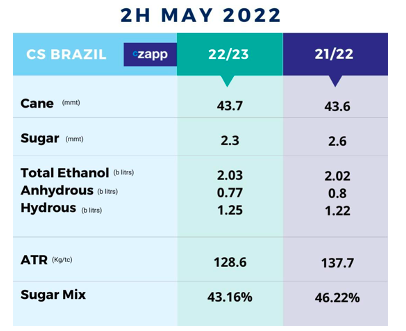

H2 May 2022 Productions Figures

Recovery in Crush Volume

- In the last 15 days of May the crushing volume came in stronger than expected with 43.7 mmt of cane harvested.

- A significant improvement compared to the previous fortnights and in line with the same period last crop.

- However, cumulative crushing is still below the previous crop at 23.3 mmt.

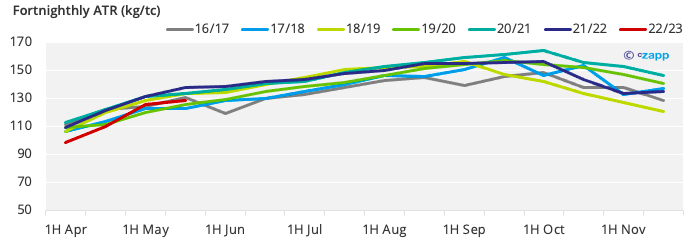

- The lower total crushing volume is related to the lower quality of the ATR (sugar content) at the beginning of the crop:

- However, in this fortnight, as expected, the plant’s ATR have recovered 3% compared to H1 May, finishing the month at 128.6 kg/tc.

- Even so, it remains below the levels from the last two crops.

5 mmt of Sugar in two months

- Sugar production advanced a little further in H2 May reaching 2.15 mmt of sugar produced.

- However, they are still below the volumes seen in the past crop:

- So far, 5.1 mmt of sugar have been produced – volume 30% lower than 21/22.

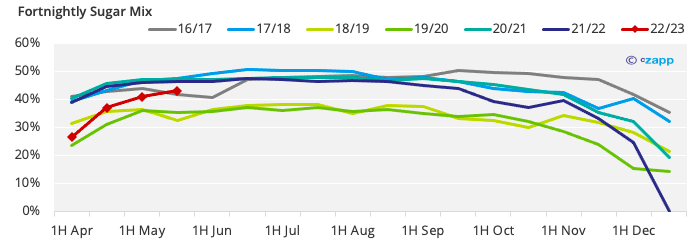

- Part of this is related to a weaker cumulative crushing and is mainly the result of the production mix.

- Most mills started the harvest by allocating more cane to ethanol production.

- According to Unica, so far 855,000 t of sugar have not been produced to be diverted to biofuel production.

- However, in this last fortnight the mix from the mills grew significantly from 40.9% to 43.2%

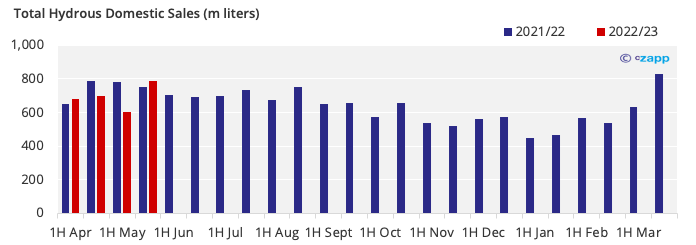

Drop in hydrous sales

- In the last 15 days of May, there was a recuperation in domestic hydrous sales:

- However, the volume of biofuel sold is still below 2021 levels:

- In May it was sold 1.39 billion l of ethanol – a 9.2% drop yoy

- This is due to the parity at the pump favoring gasoline sales in some CS states in the past’s weeks.

- Nevertheless, today the pump parity in São Paulo is 68% – transition zone for the drivers from gasoline to ethanol.

- If hydrous prices continue at this downward pace amid the advance of the crop, demand for biofuel could strengthen again.

- Unlike hydrous, anhydrous ethanol continues with the strong demand from the distributors:

- In May, 847.67 mm liters were sold – practically in line with the previous crop.

- With the strong sales of biofuels there was a boost in Cbio emissions.

- In May, 2.63 mm of Cbios were issued – the highest volume in the last 20 months.

On the radar

- This Monday (13) the Senate will vote on a bill that imposes the ICMS ceiling along with the discussion of the two other PECs – (PIS/Cofins) and Ethanol.

- The proposals, if approved, could mean a reduction of 11% to 25% in ethanol price at the pump in the state of São Paulo.

- Learn more on our Ethanol Price Outlook

Explainer that you might like:

Czapp Explains: The Brazilian Ethanol Industry