Main Topics

- Expensive gasoline for drivers can be explained mainly by two factors: (i) high oil and (ii) a weaker real.

- Despite the high, anhydrous ethanol represents a small portion of the price composition, not being the villain of the story.

- In short, we are at the mercy of the international market in our cars

Components

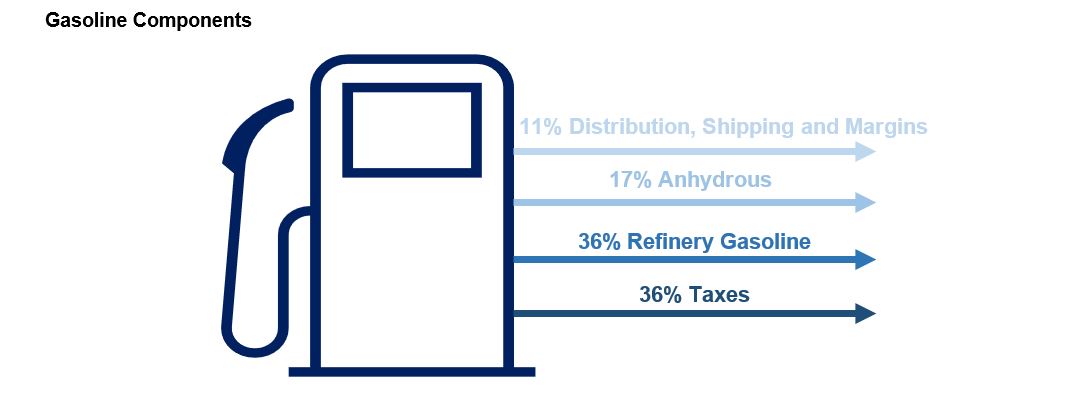

- Before explaining the rise in gasoline prices, it is important to understand what makes up its price.

- Then we can look at which parts have changed the most lately, that is, what impacted the most on the final price for consumers.

Everyone Needs a Slogan

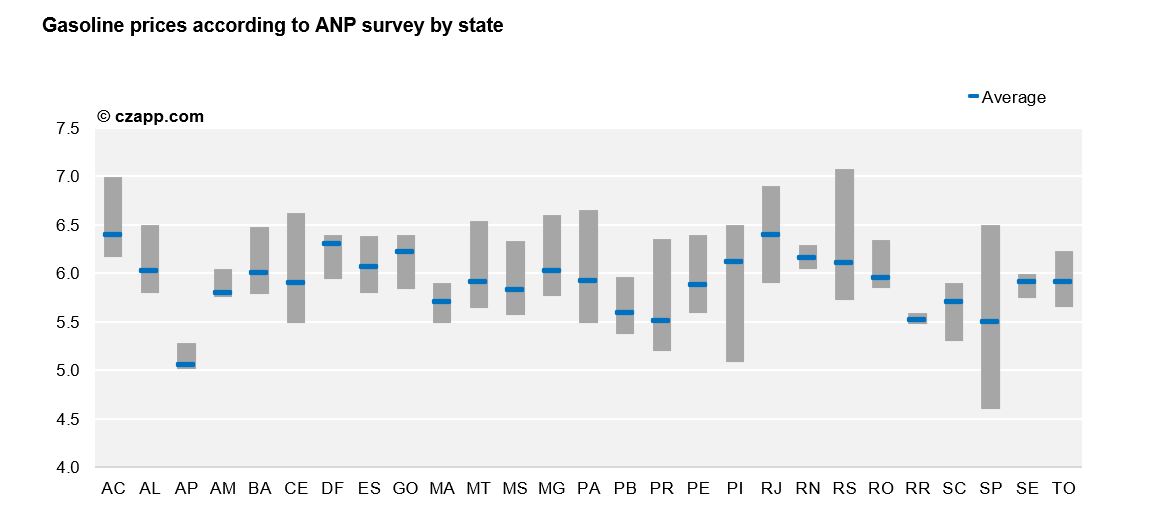

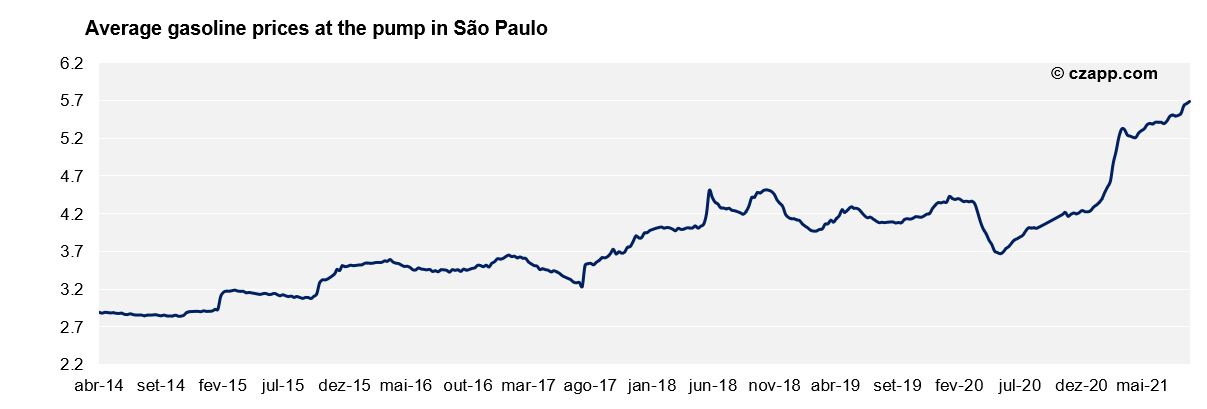

- No, gasoline is not at BRL7/liter in São Paulo.

- Every week, the ANP publishes a price survey at stations in the state of São Paulo in which it shows the average, and minimum and maximum prices.

- And so far the maximum has not reached the so-called 7 reais.

- Of course, the survey does not include the more than 8 thousand service stations in the state, but even so, we cannot say that the average price of gasoline is at this level.

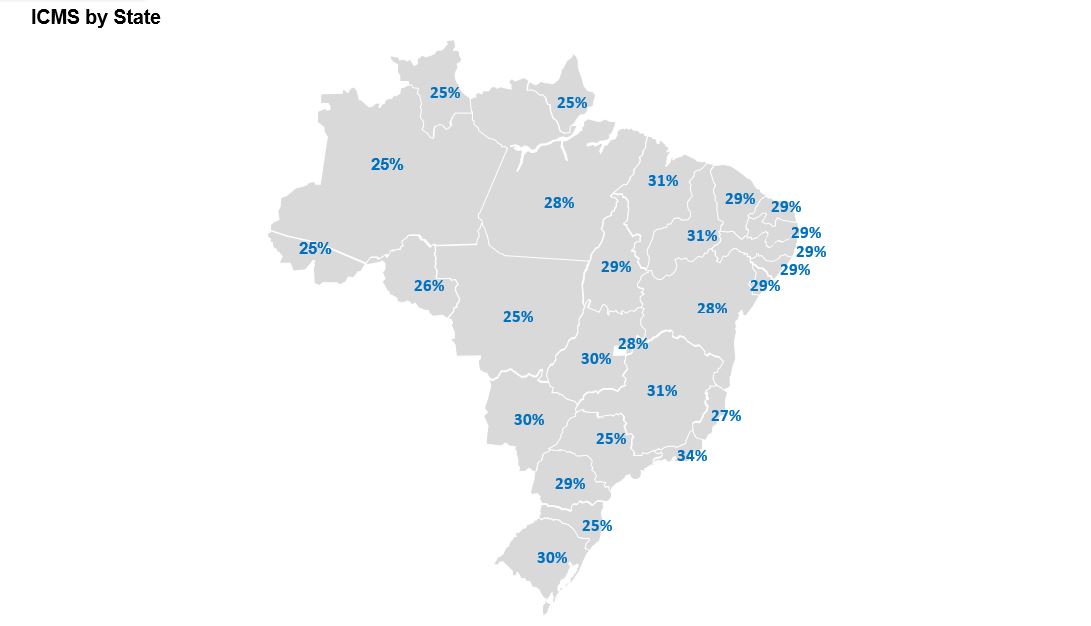

- Gasoline is subject to two federal and one state taxes: CIDE, PIS/COFINS and ICMS, respectively.

- The wide variety of prices between states is due to the difference in ICMS.

ICMS is the Villain?

- The ICMS in São Paulo is in fact one of the lowest in the country, at 25%.

- The highest champion is now with Rio de Janeiro with 34%.

- This difference in tax rates by state is currently one of the government’s platforms, calling for the equalization of states.

- But no, the tax is not the villain of rising prices.

- After all, few states increased the ICMS in the last year – except for the state of São Paulo, which preferred to raise the ICMS on ethanol instead of gasoline, going against environmental policies.

Anhydrous

- Remembering that currently all common national gasoline contains 27% anhydrous in its composition – a percentage maintained since 2015.

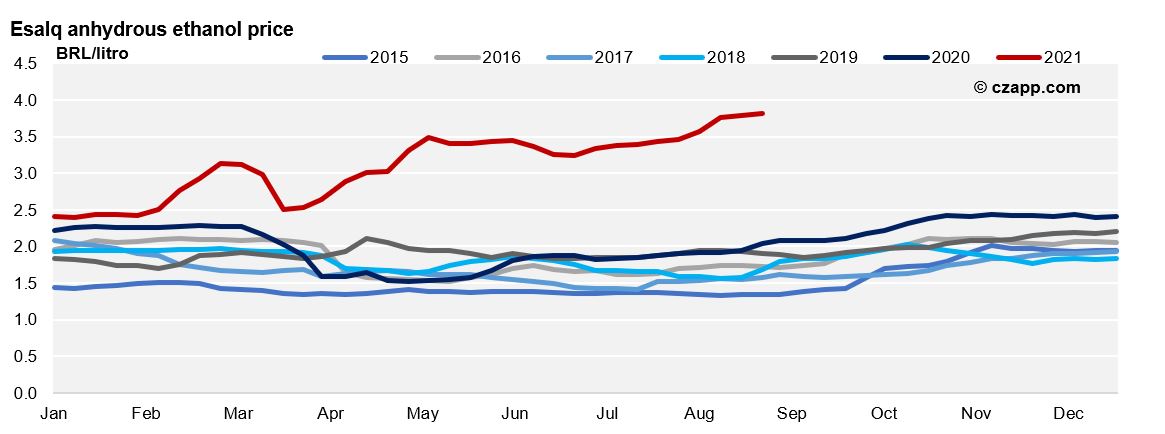

- Despite having a weight of 17% in the total composition of gasoline prices, there is no denying that the rise in ethanol this year has contributed to the increase in prices at the pump.

- The spot price of anhydrous, according to the Esalq index, is R$3.8/liter – an increase of 87% compared to the previous year.

- But most (about 90%) of the volume of anhydrous is sold against contracts, which determine an anhydrous premium over the price of hydrous ethanol.

- And after about 4 crops with a low premium, the tight stocks of this cycle allowed higher trades with the average premium getting close to 14%.

- One more price hike factor.

Gasoline

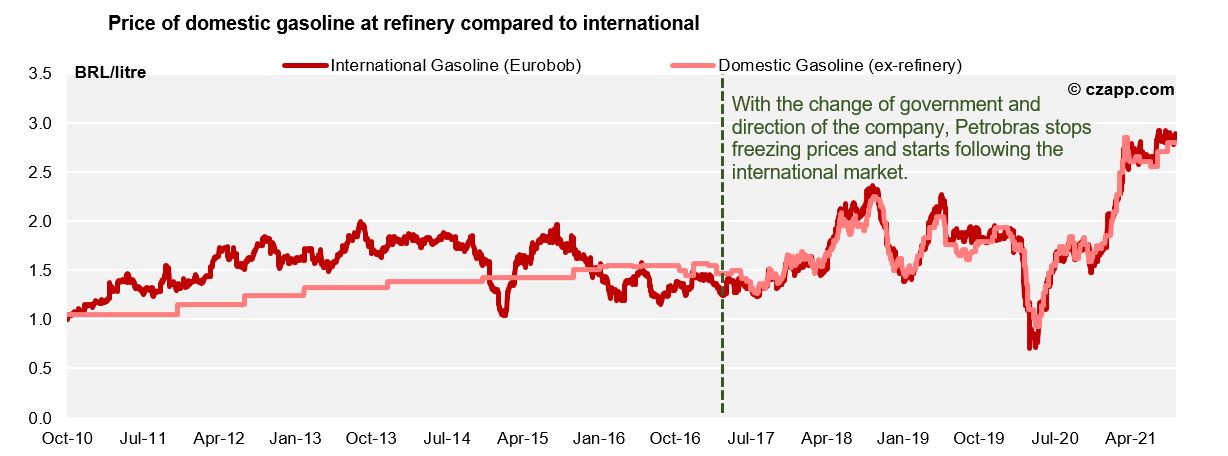

- Despite its divestment plan, Petrobras is still responsible for more than 90% of gasoline refining in the country.

- That said, the company is a price maker and follows its own formula to determine the level of prices that are readjusted according to changes in exchange rates, oil, international gasoline and even (according to them) market share.

- After historic lows last year, due to the impact on demand caused by the pandemic, the price of oil has been recovering since then – an increase of 83% in the last year.

- From cuts in supply made by OPEC to optimism with the application of vaccines around the world, the barrel today is at levels above the registered pre-pandemic.

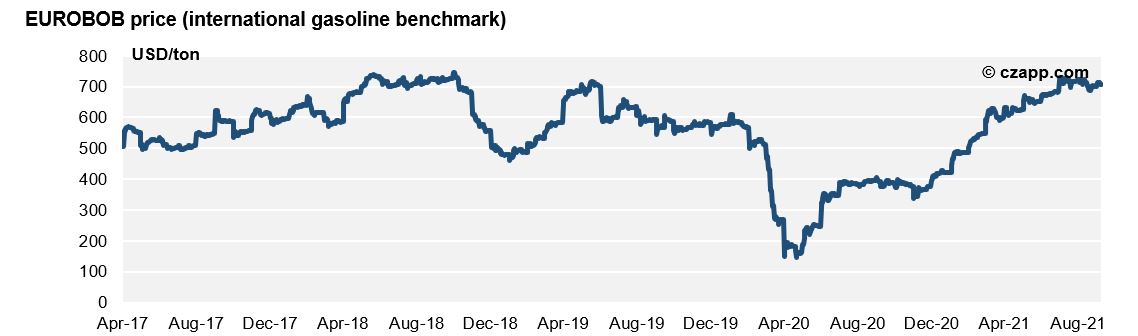

- With the recovery of oil, international gasoline also rose.

- Using EUROBOB as the benchmark for the analysis, we see that fuel prices have also risen to 2019 levels – up 88%.

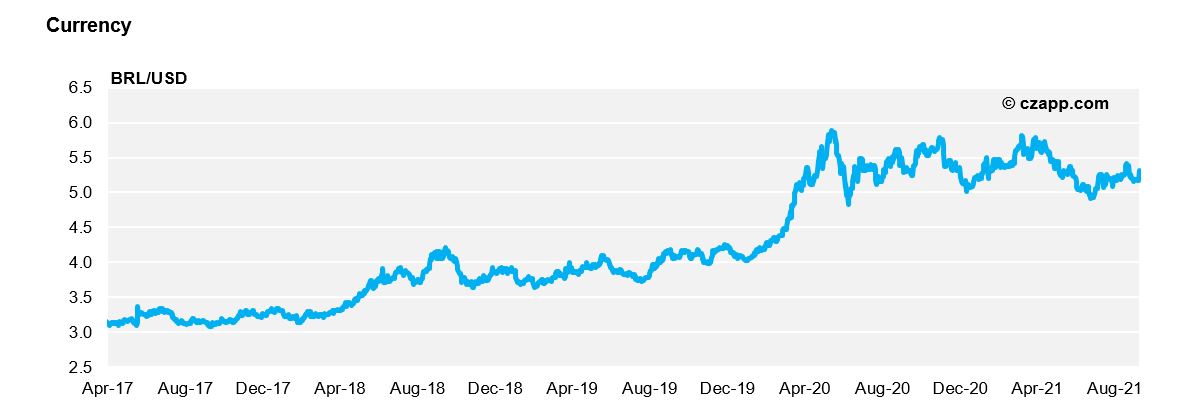

- And as if that wasn’t enough, the exchange rate remains undervalued.

- After hitting the historical maximum in nominal terms at the beginning of the pandemic, the exchange rate has not yet returned to the levels it used to be.

- With a devalued exchange rate, it becomes more expensive to import gasoline.

- And then we have the result: high exchange rates, high oil, high international gasoline and a company that maintains its policy of following an international benchmark (common to all commodities and not Petrobras’ exclusive behavior) maintains high domestic gasoline prices.

In short

- Yes, taxes in Brazil are high, but this is nothing new and they have not changed in the last year to the point of impacting the price at the pump.

- Unfortunately, the rise in oil prices came at the same time as the greater currency devaluation.

- With this combination, we reached the highest prices ever practiced at service stations in the country.

- A reversal of this scenario depends on a drop in oil prices and/or a strengthening of the Real.

Explainers that you might like