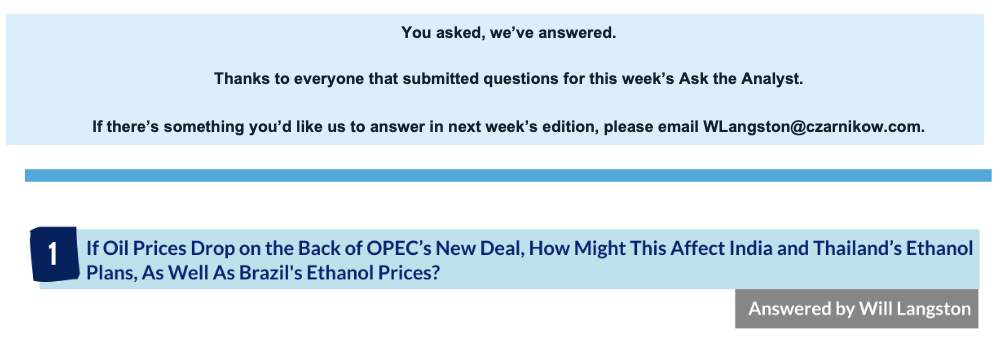

If crude oil prices fall, we don’t think there’ll be any change to India’s ethanol programme. The programme isn’t just being done for energy security reasons, nor cost, nor the environment. It’s being done to resolve the surplus sugar that’s produced each year.

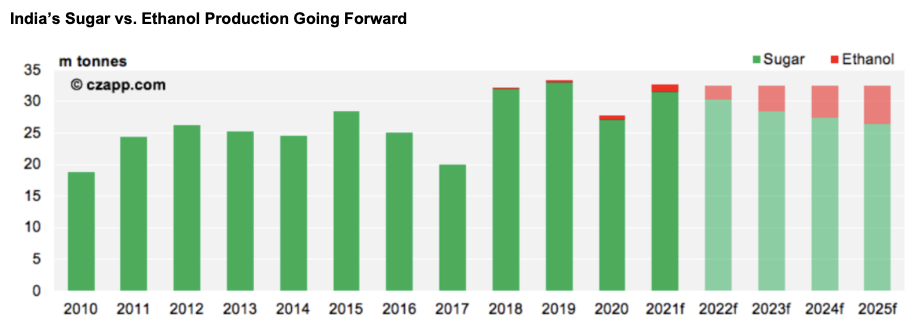

Thailand’s ambition to move from E10 to E20 has been put on hold during the COVID pandemic, so cheaper energy prices won’t change this for the time being.

Likewise, China froze its planned move to E10 in 2019.

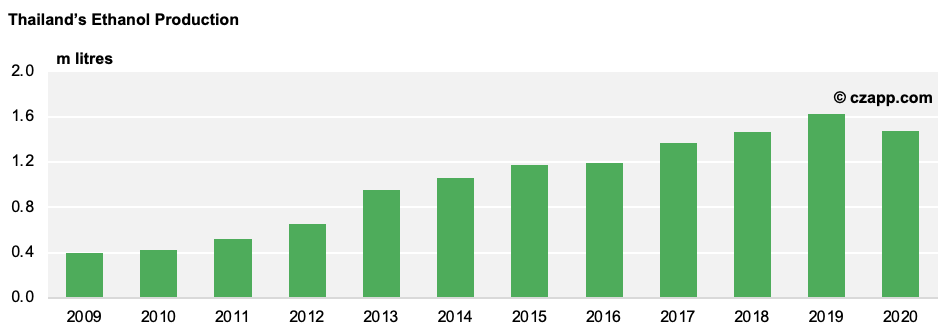

Moving on, if Brazilian energy prices fall, all other things being equal, Petrobras will come under political pressure to reduce gasoline prices. This will then make gasohol even more competitive at the pumps versus hydrous ethanol…though it’s already winning that battle.

One thing that is important is the overall market sentiment. The energy markets dwarf the soft commodity markets, so if there’s a large risk-off event in crude which leads to lower prices, some of this speculative selling will also come to sugar too. So, sugar prices could well weaken if crude oil takes the lead, but this isn’t due to parities. It’s more due to risk tolerance and investor positioning.

Other Opinions You Might Be Interested In…

- India’s E20 Ethanol Goal and its Cane Molasses Exports

- High Freight Rates Until 2023?

- More Oil: Possible Pressure on Ethanol?

Explainers You Might Be Interested In…